More Unpleasant Surprises Could Be In Store For IXICO plc's (LON:IXI) Shares After Tumbling 26%

To the annoyance of some shareholders, IXICO plc (LON:IXI) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 14%.

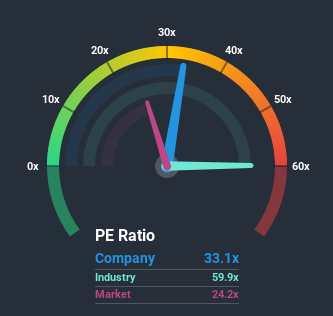

In spite of the heavy fall in price, IXICO may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 33.1x, since almost half of all companies in the United Kingdom have P/E ratios under 24x and even P/E's lower than 13x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

With earnings growth that's exceedingly strong of late, IXICO has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for IXICO

Although there are no analyst estimates available for IXICO, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Enough Growth For IXICO?

There's an inherent assumption that a company should outperform the market for P/E ratios like IXICO's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 119%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 27% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that IXICO is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From IXICO's P/E?

There's still some solid strength behind IXICO's P/E, if not its share price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that IXICO currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for IXICO that you should be aware of.

Of course, you might also be able to find a better stock than IXICO. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.