Are International Business Settlement Holdings Limited’s (HKG:147) Interest Costs Too High?

While small-cap stocks, such as International Business Settlement Holdings Limited (SEHK:147) with its market cap of HK$9.14B, are popular for their explosive growth, investors should also be aware of their balance sheet to judge whether the company can survive a downturn. Given that 147 is not presently profitable, it’s vital to assess the current state of its operations and pathway to profitability. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. Though, since I only look at basic financial figures, I’d encourage you to dig deeper yourself into 147 here.

Does 147 generate an acceptable amount of cash through operations?

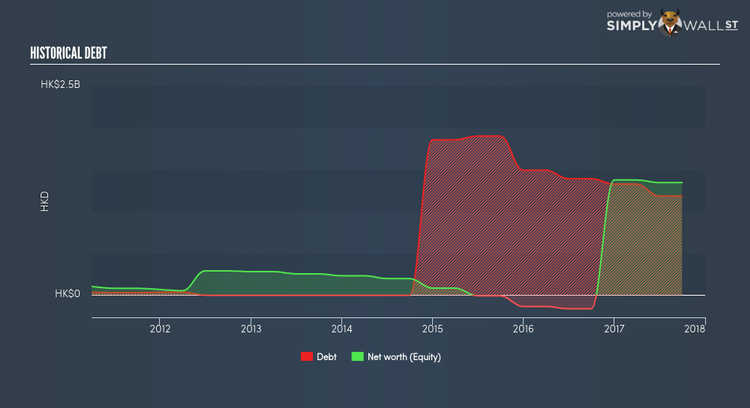

147 has shrunken its total debt levels in the last twelve months, from HK$1,490.7M to HK$1,325.0M , which is made up of current and long term debt. With this debt payback, 147’s cash and short-term investments stands at HK$1,513.4M for investing into the business. Additionally, 147 has generated HK$52.7M in operating cash flow during the same period of time, resulting in an operating cash to total debt ratio of 3.98%, signalling that 147’s operating cash is not sufficient to cover its debt. This ratio can also be a sign of operational efficiency for unprofitable companies as traditional metrics such as return on asset (ROA) requires positive earnings. In 147’s case, it is able to generate 0.04x cash from its debt capital.

Can 147 meet its short-term obligations with the cash in hand?

Looking at 147’s most recent HK$2,649.3M liabilities, it seems that the business has been able to meet these commitments with a current assets level of HK$4,171.2M, leading to a 1.57x current account ratio. Usually, for real estate companies, this is a suitable ratio since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Can 147 service its debt comfortably?

147 is a relatively highly levered company with a debt-to-equity of 88.02%. This is not unusual for small-caps as debt tends to be a cheaper and faster source of funding for some businesses. But since 147 is currently loss-making, there’s a question of sustainability of its current operations. Running high debt, while not yet making money, can be risky in unexpected downturns as liquidity may dry up, making it hard to operate.

Next Steps:

Are you a shareholder? 147’s debt and cash flow levels indicate room for improvement. Its cash flow coverage of less than a quarter of debt means that operating efficiency could be an issue. However, its high liquidity ensures the company will continue to operate smoothly should unfavourable circumstances arise. Given that its financial position may change. I suggest keeping abreast of market expectations for 147’s future growth on our free analysis platform.

Are you a potential investor? 147’s high debt levels is not met with high cash flow coverage. This leaves room for improvement in terms of debt management and operational efficiency. Though, the company will be able to pay all of its upcoming liabilities from its current short-term assets. You should continue your analysis by taking a look at 147’s past performance analysis on our free platform to figure out 147’s financial health position.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.