Can You Imagine How Elated Aemetis' (NASDAQ:AMTX) Shareholders Feel About Its 683% Share Price Gain?

The last three months have been tough on Aemetis, Inc. (NASDAQ:AMTX) shareholders, who have seen the share price decline a rather worrying 52%. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In that time, shareholders have had the pleasure of a 683% boost to the share price. So the recent fall isn't enough to negate the good performance. While winners often keep winning, it can pay to be cautious after a strong rise.

It really delights us to see such great share price performance for investors.

View our latest analysis for Aemetis

Because Aemetis made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Aemetis saw its revenue shrink by 15%. So it's very confusing to see that the share price gained a whopping 683%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

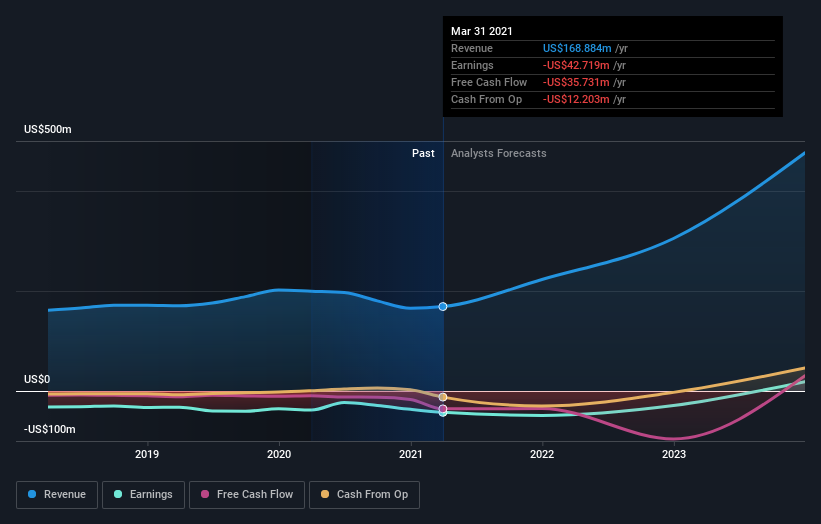

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Aemetis

A Different Perspective

It's nice to see that Aemetis shareholders have received a total shareholder return of 683% over the last year. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Aemetis better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Aemetis (including 3 which are significant) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.