Here's Why I Think Garware Technical Fibres (NSE:GARFIBRES) Might Deserve Your Attention Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Garware Technical Fibres (NSE:GARFIBRES). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Garware Technical Fibres

Garware Technical Fibres's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Garware Technical Fibres has managed to grow EPS by 27% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

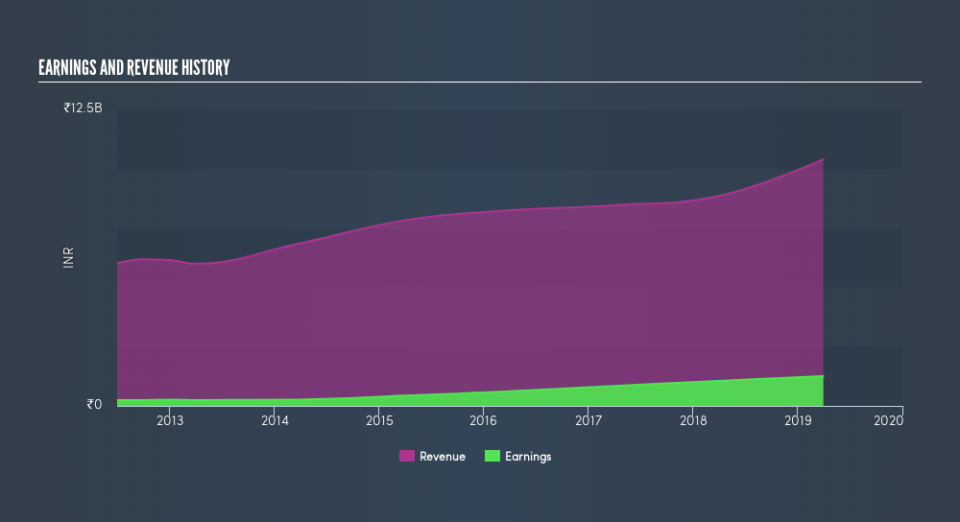

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Garware Technical Fibres is growing revenues, and EBIT margins improved by 4.1 percentage points to 19%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Garware Technical Fibres's balance sheet strength, before getting too excited.

Are Garware Technical Fibres Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Garware Technical Fibres insiders spent ₹6.1m on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the Independent & Non-Executive Director, Ashish Goel, who made the biggest single acquisition, paying ₹3.7m for shares at about ₹1,116 each.

The good news, alongside the insider buying, for Garware Technical Fibres bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at ₹4.6b, they have plenty of motivation to push the business to succeed. That holding amounts to 19% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Does Garware Technical Fibres Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Garware Technical Fibres's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Now, you could try to make up your mind on Garware Technical Fibres by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But Garware Technical Fibres isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.