Here's Why Asahi India Glass (NSE:ASAHIINDIA) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Asahi India Glass Limited (NSE:ASAHIINDIA) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Asahi India Glass

What Is Asahi India Glass's Net Debt?

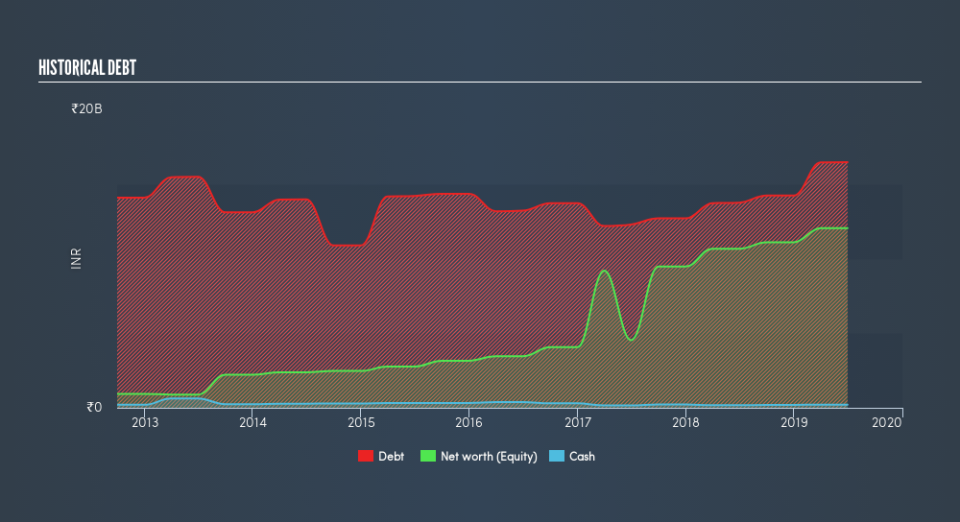

The image below, which you can click on for greater detail, shows that at March 2019 Asahi India Glass had debt of ₹16.4b, up from ₹13.8b in one year. Net debt is about the same, since the it doesn't have much cash.

A Look At Asahi India Glass's Liabilities

Zooming in on the latest balance sheet data, we can see that Asahi India Glass had liabilities of ₹13.6b due within 12 months and liabilities of ₹11.3b due beyond that. Offsetting this, it had ₹215.9m in cash and ₹2.71b in receivables that were due within 12 months. So it has liabilities totalling ₹21.9b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Asahi India Glass has a market capitalization of ₹44.1b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Asahi India Glass has a debt to EBITDA ratio of 3.1 and its EBIT covered its interest expense 3.1 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The good news is that Asahi India Glass improved its EBIT by 6.7% over the last twelve years, thus gradually reducing its debt levels relative to its earnings. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Asahi India Glass's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Asahi India Glass created free cash flow amounting to 4.8% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On the face of it, Asahi India Glass's interest cover left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at growing its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that Asahi India Glass's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.