If You Had Bought Yangzhou Guangling District Taihe Rural Micro-finance (HKG:1915) Stock A Year Ago, You'd Be Sitting On A 15% Loss, Today

It's easy to feel disappointed if you buy a stock that goes down. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. The Yangzhou Guangling District Taihe Rural Micro-finance Company Limited (HKG:1915) share price is down 15% in the last year. However, that's better than the market's overall return of -20%. Yangzhou Guangling District Taihe Rural Micro-finance may have better days ahead, of course; we've only looked at a one year period. It's down 23% in about a quarter. Of course, this share price action may well have been influenced by the 17% decline in the broader market, throughout the period.

See our latest analysis for Yangzhou Guangling District Taihe Rural Micro-finance

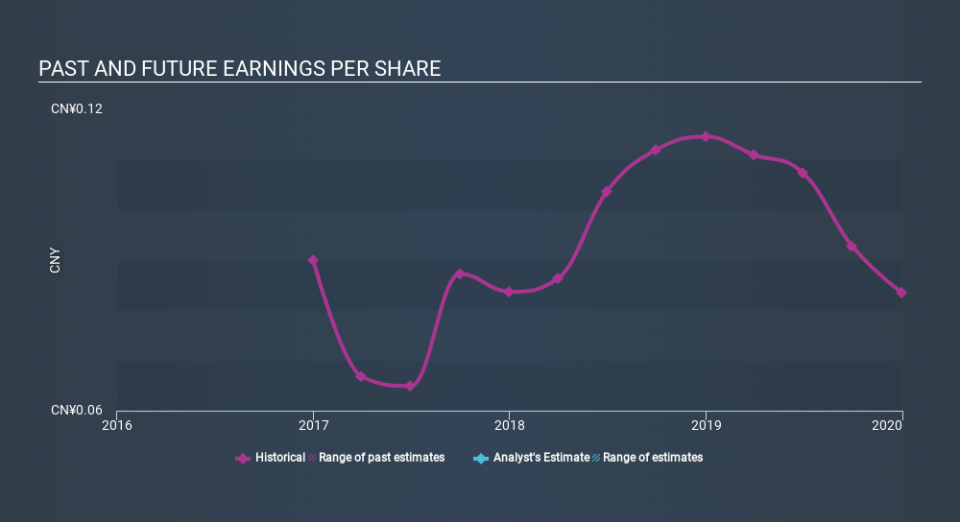

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Yangzhou Guangling District Taihe Rural Micro-finance had to report a 27% decline in EPS over the last year. This fall in the EPS is significantly worse than the 15% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Yangzhou Guangling District Taihe Rural Micro-finance's earnings, revenue and cash flow.

A Different Perspective

It's not great that Yangzhou Guangling District Taihe Rural Micro-finance shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 15% , including dividends, wasn't as bad as the broader market loss of about 20%. However, the problem arose in the last three months, which saw the share price drop 23%. It's always a worry to see a share price decline like that, but at the same time, it is an unavoidable part of investing. In times of uncertainty we usually try to focus on the long term fundamental business metrics. It's always interesting to track share price performance over the longer term. But to understand Yangzhou Guangling District Taihe Rural Micro-finance better, we need to consider many other factors. Even so, be aware that Yangzhou Guangling District Taihe Rural Micro-finance is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.