If You Had Bought Suchuang Gas (HKG:1430) Stock A Year Ago, You'd Be Sitting On A 29% Loss, Today

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Suchuang Gas Corporation Limited (HKG:1430) shareholders over the last year, as the share price declined 29%. That's disappointing when you consider the market returned -0.3%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 10% in three years.

See our latest analysis for Suchuang Gas

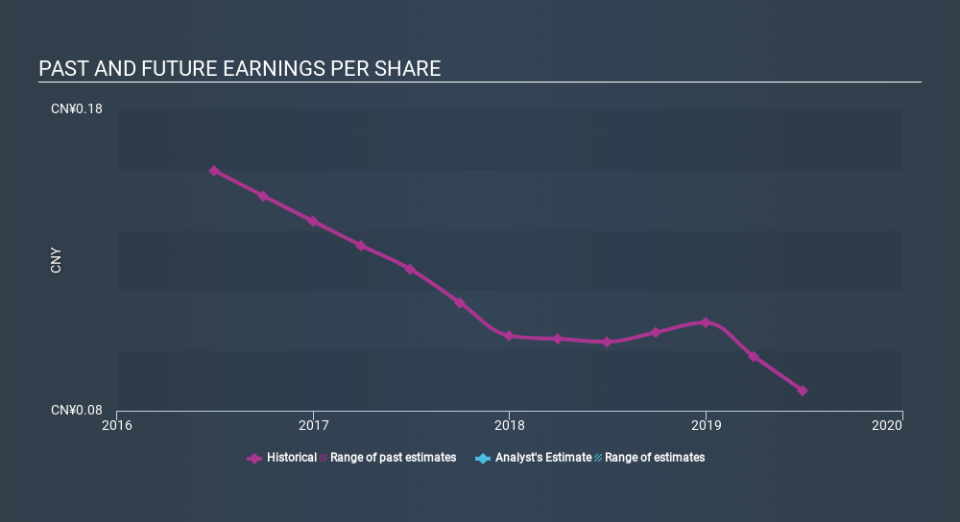

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unfortunately Suchuang Gas reported an EPS drop of 16% for the last year. This reduction in EPS is not as bad as the 29% share price fall. This suggests the EPS fall has made some shareholders are more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Suchuang Gas's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Suchuang Gas's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Suchuang Gas shareholders, and that cash payout explains why its total shareholder loss of 28%, over the last year, isn't as bad as the share price return.

A Different Perspective

The last twelve months weren't great for Suchuang Gas shares, which performed worse than the market, costing holders 28% , including dividends . Meanwhile, the broader market slid about 0.3%, likely weighing on the stock. The three-year loss of 2.3% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Before deciding if you like the current share price, check how Suchuang Gas scores on these 3 valuation metrics.

We will like Suchuang Gas better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.