GBP/USD Rallies Back Above $1.5200 as June PMI Manufacturing Beats

THE TAKEAWAY: Further signs that the British economy has accelerated in the 2Q’13 have helped ease growth fears stemming from last week’s big 1Q’13 GDP revision lower > GBPUSD BULLISH

The United Kingdom had several events out on the docket this morning, and following the trend of positive surprises after the May PMI figures were released several weeks ago, incoming May and the first looks at June data have proved constructive for bullish price action in the British Pound. Specifically, the data suggests that 2Q’13 growth pointed higher, which has increased importance in the wake of the 1Q’13 GDP revision, that saw the UK’s annualized growth rate cut in half from +0.6% to +0.3%. Here is today’s important data fueling the rally:

- PMI Manufacturing (JUN): 52.5 versus 51.4 expected, from 51.5 (revised higher from 51.3)

- Net Consumer Credit (MAY): £0.7B versus 0.6B expected, from 0.6B (revised higher from 0.5B)

- Mortgage Approvals (MAY): 58.2K versus 55.8K expected, from 54.4K (revised higher from 53.7K)

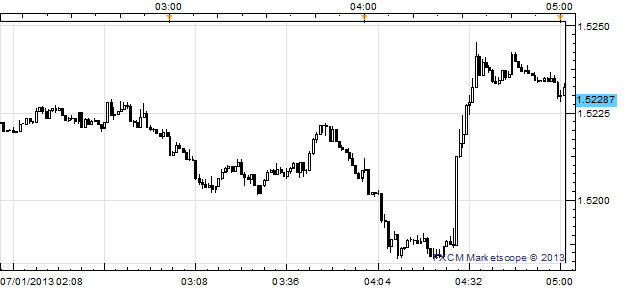

GBPUSD 1-minute Chart: July 1, 2013

Charts Created using Marketscope – prepared by Christopher Vecchio

The British Pound was down across the board ahead of the data, but trade reversed quickly on the beats all around. The GBPUSD rallied from $1.5183 ahead of the releases to as high as 1.5245 within five minutes, but had fallen back to 1.5229 at the time this report was written. Elsewhere, the GBPJPY staged an impressive turnaround, rallying from ¥151.15 to as high as 151.83, before settling near 151.70.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.