First Sponsor Group Limited (SGX:ADN): Time For A Financial Health Check

Investors are always looking for growth in small-cap stocks like First Sponsor Group Limited (SGX:ADN), with a market cap of SGD831.64M. However, an important fact which most ignore is: how financially healthy is the business? Evaluating financial health as part of your investment thesis is essential, since poor capital management may bring about bankruptcies, which occur at a higher rate for small-caps. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. Nevertheless, this commentary is still very high-level, so I’d encourage you to dig deeper yourself into ADN here.

Does ADN generate enough cash through operations?

ADN’s debt levels have fallen from SGD477.1M to SGD356.6M over the last 12 months , which is made up of current and long term debt. With this debt payback, ADN’s cash and short-term investments stands at SGD280.6M for investing into the business. Moreover, ADN has produced SGD75.6M in operating cash flow in the last twelve months, resulting in an operating cash to total debt ratio of 21.20%, indicating that ADN’s current level of operating cash is high enough to cover debt. This ratio can also be a sign of operational efficiency as an alternative to return on assets. In ADN’s case, it is able to generate 0.21x cash from its debt capital.

Does ADN’s liquid assets cover its short-term commitments?

At the current liabilities level of SGD410.1M liabilities, the company has been able to meet these commitments with a current assets level of SGD1,072.7M, leading to a 2.62x current account ratio. For real estate companies, this ratio is within a sensible range since there’s sufficient cash cushion without leaving too much capital idle or in low-earning investments.

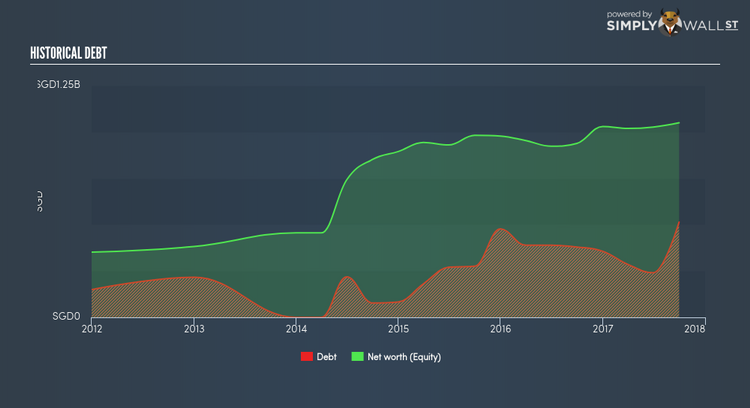

Is ADN’s level of debt at an acceptable level?

With a debt-to-equity ratio of 48.94%, ADN can be considered as an above-average leveraged company. This is not unusual for small-caps as debt tends to be a cheaper and faster source of funding for some businesses.

Next Steps:

Are you a shareholder? Although ADN’s debt level is towards the higher end of the spectrum, its cash flow coverage seems adequate to meet obligations which means its debt is being efficiently utilised. Since there is also no concerns around ADN’s liquidity needs, this may be its optimal capital structure for the time being. Going forward, ADN’s financial situation may change. You should always be keeping on top of market expectations for ADN’s future growth on our free analysis platform.

Are you a potential investor? ADN’s high debt level shouldn’t scare off investors just yet. Its operating cash flow seems adequate to meet obligations which means its debt is being put to good use. Furthermore, the company exhibits an ability to meet its near term obligations should an adverse event occur. To gain more confidence in the stock, you need to also examine the company’s track record. I encourage you to continue your research by taking a look at ADN’s past performance analysis on our free platform to conclude on ADN’s financial health.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.