Finbar Group (ASX:FRI) shareholders have endured a 17% loss from investing in the stock five years ago

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Finbar Group Limited (ASX:FRI), since the last five years saw the share price fall 35%. The falls have accelerated recently, with the share price down 10% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Finbar Group

While Finbar Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over half a decade Finbar Group reduced its trailing twelve month revenue by 13% for each year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 6% per year in that time. This loss means the stock shareholders are probably pretty annoyed. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

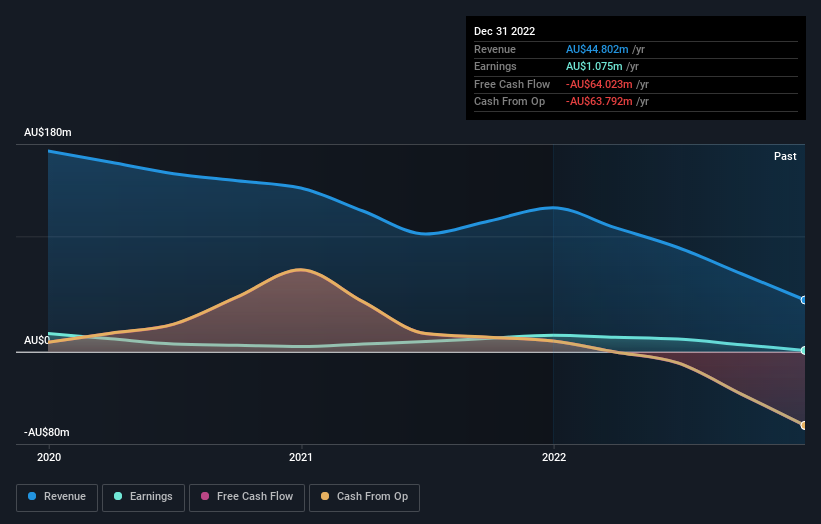

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

We've already covered Finbar Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Finbar Group's TSR of was a loss of 17% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Finbar Group had a tough year, with a total loss of 18%, against a market gain of about 0.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Finbar Group better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Finbar Group (including 3 which are a bit unpleasant) .

Finbar Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here