Is Entertainment Network (India) Limited’s (NSE:ENIL) CEO Overpaid Relative To Its Peers?

Prashant Panday has been the CEO of Entertainment Network (India) Limited (NSE:ENIL) since 2007. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Entertainment Network (India)

How Does Prashant Panday’s Compensation Compare With Similar Sized Companies?

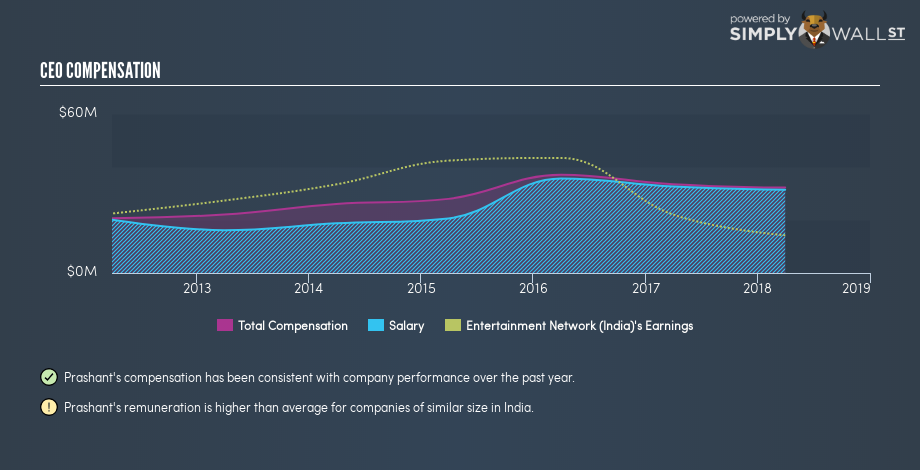

Our data indicates that Entertainment Network (India) Limited is worth ₹29b, and total annual CEO compensation is ₹32m. (This figure is for the year to 2018). Notably, the salary of ₹31m is the vast majority of the CEO compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of ₹14b to ₹56b. The median total CEO compensation was ₹22m.

As you can see, Prashant Panday is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Entertainment Network (India) Limited is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance.

The graphic below shows how CEO compensation at Entertainment Network (India) has changed from year to year.

Is Entertainment Network (India) Limited Growing?

Over the last three years Entertainment Network (India) Limited has shrunk its earnings per share by an average of 43% per year. Its revenue is up 1.4% over last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. The fairly low revenue growth fails to impress given that the earnings per share is down. These factors suggest that the business performance wouldn’t really justify a high pay packet for the CEO.

It could be important to check this free visual depiction of what analysts expect for the future.

Has Entertainment Network (India) Limited Been A Good Investment?

Since shareholders would have lost about 15% over three years, some Entertainment Network (India) Limited shareholders would surely be feeling negative emotions. So shareholders would probably think the company shouldn’t be too generous with CEO compensation.

In Summary…

We examined the amount Entertainment Network (India) Limited pays its CEO, and compared it to the amount paid by similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

We think many shareholders would be underwhelmed with the business growth over the last three years.

Arguably worse, investors are without a positive return for the last three years. Some might well form the view that the CEO is paid too generously! CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Entertainment Network (India) (free visualization of insider trades).

Or you might prefer this data-rich interactive visualization of historic revenue and earnings.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.