Is Duty Free International Limited (SGX:5SO) A Risky Dividend Stock?

Is Duty Free International Limited (SGX:5SO) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

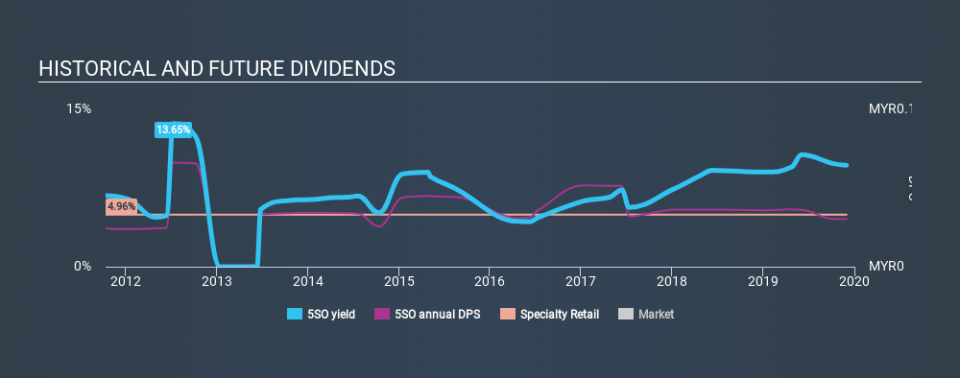

With a eight-year payment history and a 9.7% yield, many investors probably find Duty Free International intriguing. We'd agree the yield does look enticing. The company also bought back stock equivalent to around 0.7% of market capitalisation this year. Some simple analysis can reduce the risk of holding Duty Free International for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Duty Free International!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Duty Free International paid out 147% of its profit as dividends, over the trailing twelve month period. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. The company paid out 86% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn. It's good to see that while Duty Free International's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

While the above analysis focuses on dividends relative to a company's earnings, we do note Duty Free International's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Duty Free International's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The first recorded dividend for Duty Free International, in the last decade, was eight years ago. It's good to see that Duty Free International has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past eight-year period, the first annual payment was RM0.036 in 2011, compared to RM0.046 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.8% a year over that time. Duty Free International's dividend payments have fluctuated, so it hasn't grown 2.8% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's not great to see that Duty Free International's have fallen at approximately 8.5% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

To summarise, shareholders should always check that Duty Free International's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In this analysis, Duty Free International doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Duty Free International stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.