Does Trade Me Group Limited’s (NZSE:TME) Debt Level Pose A Serious Problem?

Trade Me Group Limited (NZSE:TME) is a small-cap stock with a market capitalization of NZD NZ$1.79B. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. There are always disruptions which destabilize an existing industry, in which most small-cap companies are the first casualties. These factors make a basic understanding of a company’s financial position of utmost importance for a potential investor. Here are a few basic checks that are good enough to have a broad overview of the company’s financial strength. View our latest analysis for Trade Me Group

Does TME generate enough cash through operations?

Unxpected adverse events, such as natural disasters and wars, can be a true test of a company’s capacity to meet its obligations. These catastrophes does not mean the company can stop servicing its debt obligations. We can test the impact of these adverse events by looking at whether cash from its current operations can pay back its current debt obligations. TME’s recent operating cash flow was 0.95 times its debt within the past year. A ratio of over 0.5x is a positive sign and shows that TME is generating more than enough cash from its core business, which should increase its potential to pay back near-term debt.

Does TME’s liquid assets cover its short-term commitments?

In addition to debtholders, a company must be able to pay its bills and salaries to keep the business running. In times of adverse events, TME may need to liquidate its short-term assets to pay these immediate obligations. We should examine if the company’s cash and short-term investment levels match its current liabilities. Our analysis shows that TME does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

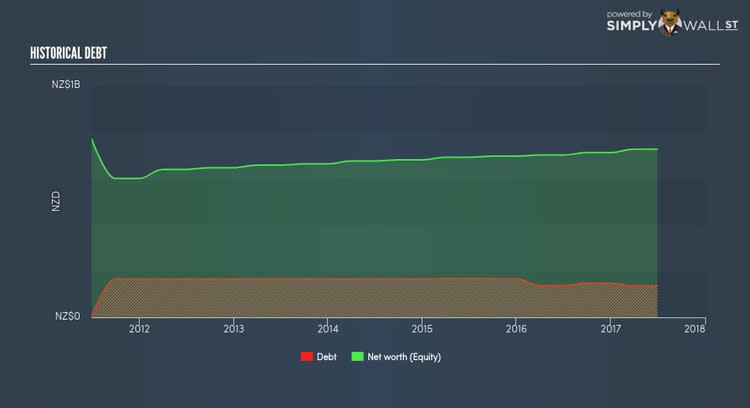

Is TME’s level of debt at an acceptable level?

While ideally the debt-to equity ratio of a financially healthy company should be less than 40%, several factors such as industry life-cycle and economic conditions can result in a company raising a significant amount of debt. In the case of TME, the debt-to-equity ratio is 18.84%, which indicates that its debt is at an acceptable level. No matter how high the company’s debt, if it can easily cover the interest payments, it’s considered to be efficient with its use of excess leverage. A company generating earnings at least three times its interest payments is considered financially sound. TME’s interest on debt is sufficiently covered by earnings as it sits at around 34.88x. Debtors may be willing to loan the company more money, giving TME ample headroom to grow its debt facilities.

Next Steps:

Are you a shareholder? TME’s high cash coverage and low debt levels indicate its ability to utilise its borrowings efficiently in order to generate ample cash flow. In addition to this, the company will be able to pay all of its upcoming liabilities from its current short-term assets. In the future, TME’s financial situation may change. You should always be researching market expectations for TME’s future growth on our free analysis platform.

Are you a potential investor? TME’s relatively safe debt levels is even more impressive due to its ability to generate high cash flow, which illustrates operating efficiency. In addition, its high liquidity means the company should continue to operate smoothly in the case of adverse events. To gain more confidence in the stock, you need to further examine the company’s track record. As a following step, you should take a look at TME’s past performance analysis on our free platform in order to determine for yourself whether its debt position is justified.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.