Does Khaitan (India)'s (NSE:KHAITANLTD) Share Price Gain of 96% Match Its Business Performance?

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Khaitan (India) Limited (NSE:KHAITANLTD), which is up 96%, over three years, soundly beating the market return of 19% (not including dividends).

View our latest analysis for Khaitan (India)

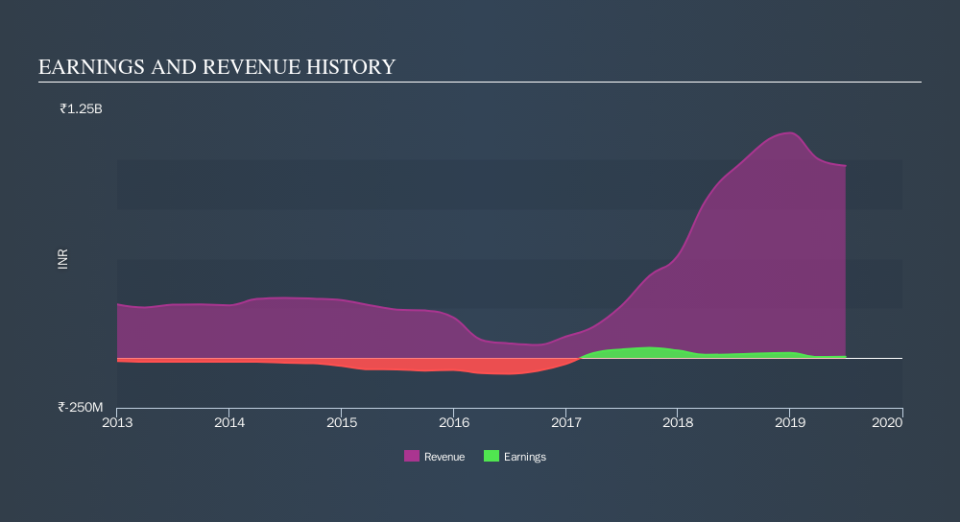

Given that Khaitan (India) only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years Khaitan (India) has grown its revenue at 74% annually. That's well above most pre-profit companies. The share price rise of 25% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put Khaitan (India) on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Khaitan (India)'s earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 1.2% in the last year, Khaitan (India) shareholders lost 54%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 4.8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how Khaitan (India) scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.