How Confident Are Insiders About Beijing Urban Construction Design & Development Group Co Limited (HKG:1599)?

Beijing Urban Construction Design & Development Group Co., Limited, together with its subsidiaries, provides various professional services for urban construction. Beijing Urban Construction Design & Development Group’s insiders have divested from 174.00k shares in the large-cap stock within the past three months. It is widely considered that insider selling stock in their own companies is potentially a bearish signal. The MIT Press (1998) published an article showing that stocks following insider selling underperformed the market by 2.7%. However, these signals may not be enough to gain conviction on whether to divest. I will be analysing whether these selling activities are supported by favourable future outlook and recent share price volatility.

Check out our latest analysis for Beijing Urban Construction Design & Development Group

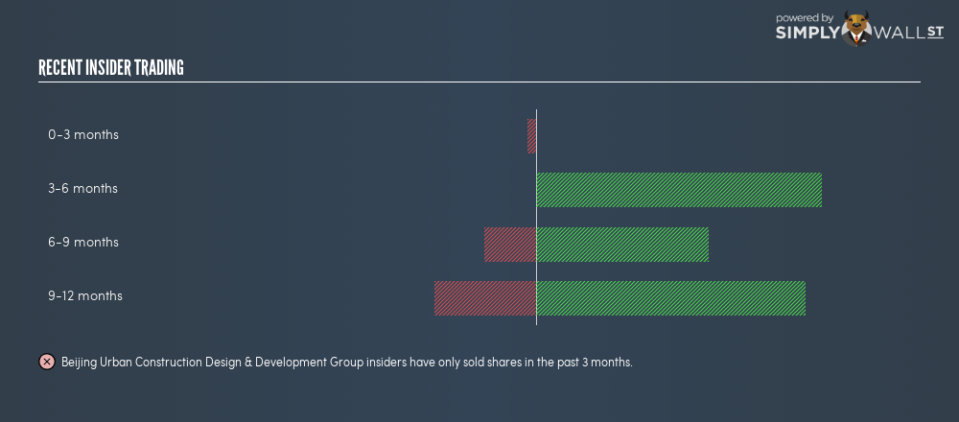

Who Are Selling Their Shares?

Over the past three months, more shares have been sold than bought by Beijing Urban Construction Design & Development Group’s insiders. In total, individual insiders own less than one million shares in the business, or around 0.011% of total shares outstanding. . The entity that sold on the open market in the last three months was Amundi Asset Management. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

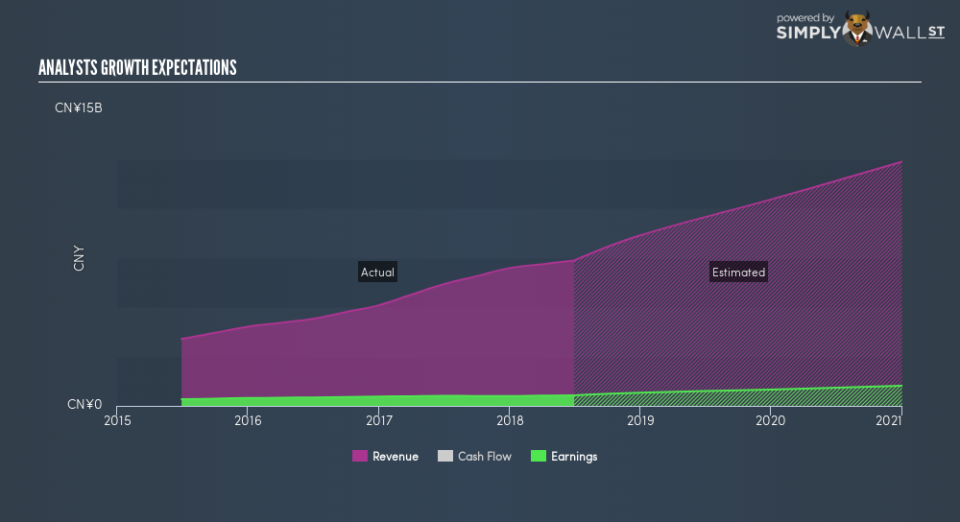

Does Selling Activity Reflect Future Growth?

On the surface, analysts’ earnings growth projection of 83.4% over the next three years provides an exceptional outlook for the business. However, this is inconsistent with the signal company insiders are sending with their net selling activity. Delving deeper into the line items, analysts anticipate a double-digit top-line growth over the next year, which seems to drive higher expected earnings growth as well. This could indicate significant cost-cutting activities or a high degree of economies of scale which may have a compounding impact in the future. However, company insiders appear to know something the market doesn’t and have been divesting from the stock. This may mean they believe the impressive net income growth is hard to sustain or that optimistic sentiment has led to inflation of the share price.

Can Share Price Volatility Explain The Sell?

Another factor we should consider is whether the timing of these insider transactions coincide with any significant share price movements. A correlation could mean directors are trading on market inefficiencies based on their belief of the company’s intrinsic value. In the past three months, Beijing Urban Construction Design & Development Group’s share price reached a high of HK$3.94 and a low of HK$3.25. This indicates some volatility with a share price change of of 21.23%. Perhaps not a significant enough movement to warrant transactions, thus motivation may be a result of their belief in the company in the future or simply personal needs.

Next Steps:

Beijing Urban Construction Design & Development Group’s net selling activity tells us the stock has fallen out of favour with some insiders as of late, however, this is rather cautious relative to analysts’ earnings expectation, and the share price movement may be too trivial to cash in on any mispricing. However, it’s important to keep in mind, insider selling may not necessarily be based on their belief of the company’s ability to perform in the future. Moreover, while insider selling can be a useful prompt, following the lead of an insider, however, will never replace diligent research. I’ve put together two key factors you should further examine:

Financial Health: Does Beijing Urban Construction Design & Development Group have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Other High Quality Alternatives : Are there other high quality stocks you could be holding instead of Beijing Urban Construction Design & Development Group? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.