CoinDesk report: ICO funding exploded in December

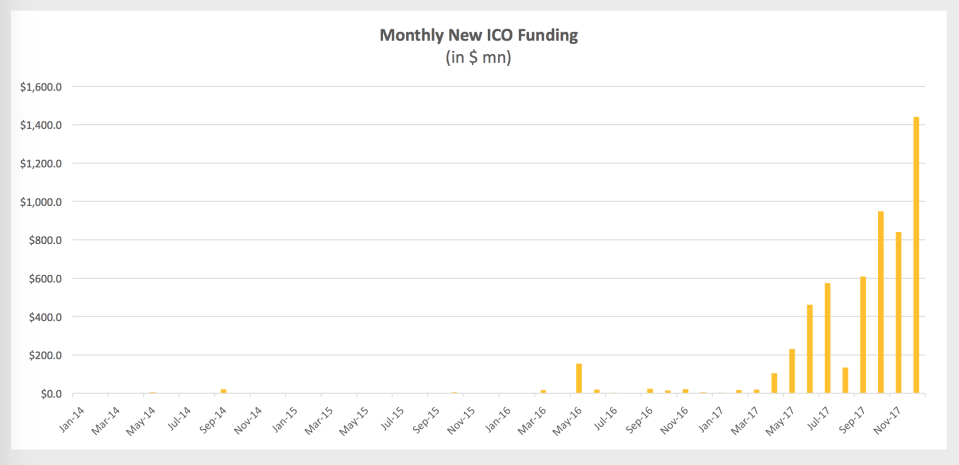

Despite warnings from far and wide about the high risks of investing in an initial coin offering (ICO), more money was raised through ICOs in December 2017 than in any single month ever before, according to CoinDesk’s new Q4 2017 State of Blockchain report.

CoinDesk’s director of research Nolan Bauerle unveiled the report live on stage at the Yahoo Finance All Markets Summit: Crypto on Wednesday.

An ICO or “token sale” is a popular, still-new method for an internet startup to raise capital, in which the company sells a supply of digital tokens for later use in its own ecosystem. Investors can buy the tokens using other cryptocurrencies like bitcoin or ether, or in many cases US dollars. Most ICOs are offered over Ethereum, a blockchain for smart contracts. Ethereum itself launched in 2014 by doing a token sale, though the concept was not yet widespread.

Investing in an ICO is highly risky, and not at all like buying shares in an IPO: The tokens are not shares; you are not getting equity in the company; and there is no guarantee the token will gain value, and nothing the company doing the ICO owes you. In the first week of December, SEC Chairman Jay Clayton issued a warning to the public about ICOs: “There is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation.”

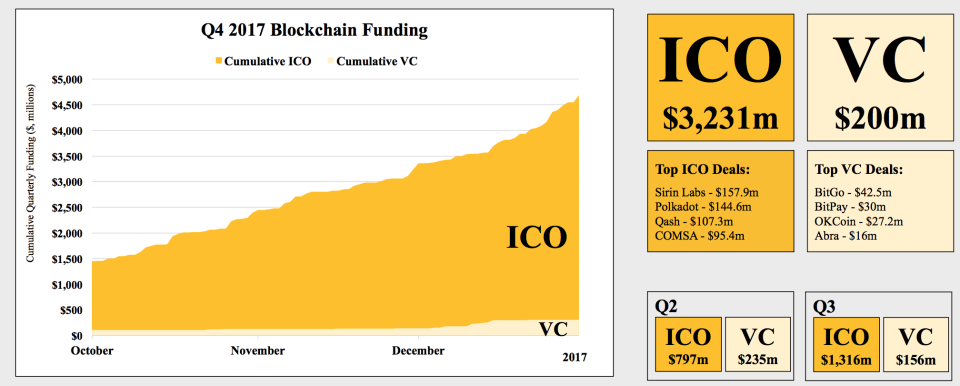

Nonetheless, that very month, eager investors spent more than $1.4 billion in token sales. CoinDesk’s data shows that all-time cumulative funding raised through ICOs is at $5.68 billion, and a stunning $3.23 billion of that came in Q4 of 2017.

And despite the risks of an ICO, here’s proof that at least in the cryptocurrency space, the ICO is replacing the traditional venture capital route. In every quarter of 2017, but especially in Q4, money raised through ICOs more than doubled the money raised from VC deals (by crypto-related companies).

And yet, the crypto companies that raised big VC rounds in 2017, including BitGo ($42.5 million) and BitPay ($30 million), are far more recognizable household names in the industry than those that pulled off mega token sales, like Polkadot ($144.6 million ICO) and Qash ($107.3 million). Perhaps that says something.

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Safety is ‘not in the ICO vocabulary’

The 11 biggest names in crypto right now