Cocoa Futures Skyrocket 40%, Leading to Decline in Confectioners' Stocks

Cocoa futures skyrocketed 40% month over month, which led to a decline in confectioners' stocks. But they are still in good shape?

What's happening?

Cocoa ICE Futures touched $10,000 per metric ton.

Source: tradingview.com

This is an unprecedented rally. The prices have been rather volatile before, fluctuating from $2,000 to $3,000 per metric ton. This year, however, they didn't just renew the all-time high set in 1977 at $4,660 but soared 2.5 times YTD and reached the psychologically significant mark of $10,000 a ton. In the last month alone, cocoa beans have risen in price by 40%. However, with inflation at about 400% over 47 years, their current price is lower than it had been back then, but commodities do not rise in price in proportion to overall inflation.

Drivers

Cocoa futures growth started last June, driven by supply shortages.

Of the total production, 70% comes from Africa, with about 50% of cocoa produced in Cote d'Ivoire and 12% in neighboring Ghana. South America provides another 15% of the world's production, including Ecuador, Cameroon and Brazil. Around 12% of global cocoa beans are grown in Asia, mainly in Indonesia, which accounts for 11%.

Cocoa production in Ghana is expected to fall 25% to 650,000 metric tons this year. Cote d'Ivoire's first harvest is projected to be 400,000 metric tons (down 33% year over year). The benchmarks for subsequent harvests are being refined. If the reduction in the harvest will be comparable, the world market will lose more than 800,000 tons of cocoa beans this year, or about 15% of their global production. This is larger than any country's production, except for the leading one. It is impossible to compensate for such a volume, especially now as the season has already started. The International Cocoa Organization (ICCO) reported a supply shortfall from Cote d'Ivoire and Ghana, resulting in a 28% and 35% decrease in arrivals at ports, respectively compared to the previous season. But now the ICOO expects only a deficit of 374,000 metric tons, that is five times higher than a year ago. Wholesale inventories are running out and may be shipped to the European market, increasing the U.S. deficit.

Should we expect a pullback?

The quotes appear to be overbought. The market conditions are very similar to the rally of two years ago in the nickel market, when short sellers covered margin calls at extremely high prices. The Financial Times reported the price hike was caused by the speculations of a hedge fund. Nevertheless, the shortage of this commodity on the medium-term horizon is quite real, and growth is demonstrated not only by the nearest futures all the trading contracts are much higher than a year ago.

July 2024 ICE contracts are trading 5% lower than May 2024 contracts, while the backwardation in September contracts is 13%. May contracts have a 35% backwardation. Traders agree the market is overheated, but do not expect a speedy cooldown this year.

In April, the situation on the cocoa bean market will be quite volatile. Most likely, the quotes will see a noticeable correction. But in the summer, when the reliable forecasts of the most recent harvest in Cote d'Ivoire appear, the situation may heat up again.

Is there a future supply risk?

Supply shortages in Cote d'Ivoire and Ghana are partially caused by the bad weather conditions. The rains damaged the first harvest and drought could destroy the next one. A lot of cocoa trees in Africa are getting older and suffer from the Black Pod disease. The cocoa plantation areas are constantly decreasing due to illegal logging activities.

Problems with the areas for new trees also come from EU restrictions. The European Union prohibits imports of cocoa grown in the area of relic forests, demanding QR-coded producer certificates from importers. Bloomberg reported that 30% of cocoa in Cote d'Ivoire is grown in potentially restricted areas. It takes at least six years to grow a new generation of cocoa trees. Over the past 20 years, the area of cocoa trees in Cote d'Ivoire has declined by about 900,000 acres. And there is strong a downtrend in production, especially in Ghana. Since 2020, production has declined by 30%. In Cote d'Ivoire, the harvest will be less than 2 million tons for the first time since 2017. The logistics failures also move the price upwards. The Port of Baltimore, which is now blocked, is one of the five possible delivery points of the cocoa. A deficit is looming and the situation could get worse in the future.

Why is it important?

Cocoa is a crucial raw material in confectionary. In 2022-23, global cocoa production exceeded 5.80 million metric tons.

The U.S. imports processed cocoa powder from the Netherlands, where Cote d'Ivoire, Malaysia, Ghana and other countries supply the raw materials. Monthly imports range from $30 million to $130 million on average. The U.S. is among the biggest cocoa product importers and one of the top chocolate exporters. In 2022, the U.S. imported cocoa beans worth $942 million and exported chocolate products totaling $1.90 billion. The imports are usually at their maximums at the end and at the beginning of each year. Last January, cocoa products worth $124 million were imported, and in the same month of 2010 it was a record of $300 million.

Futures have been also performing according to the seasonal fluctuations, often reaching their maximums at the beginning or at the end of each year, declining in the summer.

Cocoa price growth would significantly impact the U.S. confectionary market. The U.S. National Confectioners Association reported that revenue of the confectionary market added $48 billion in 2023. Chocolate makers with $25.90 billion production lead the industry.

Under the radar

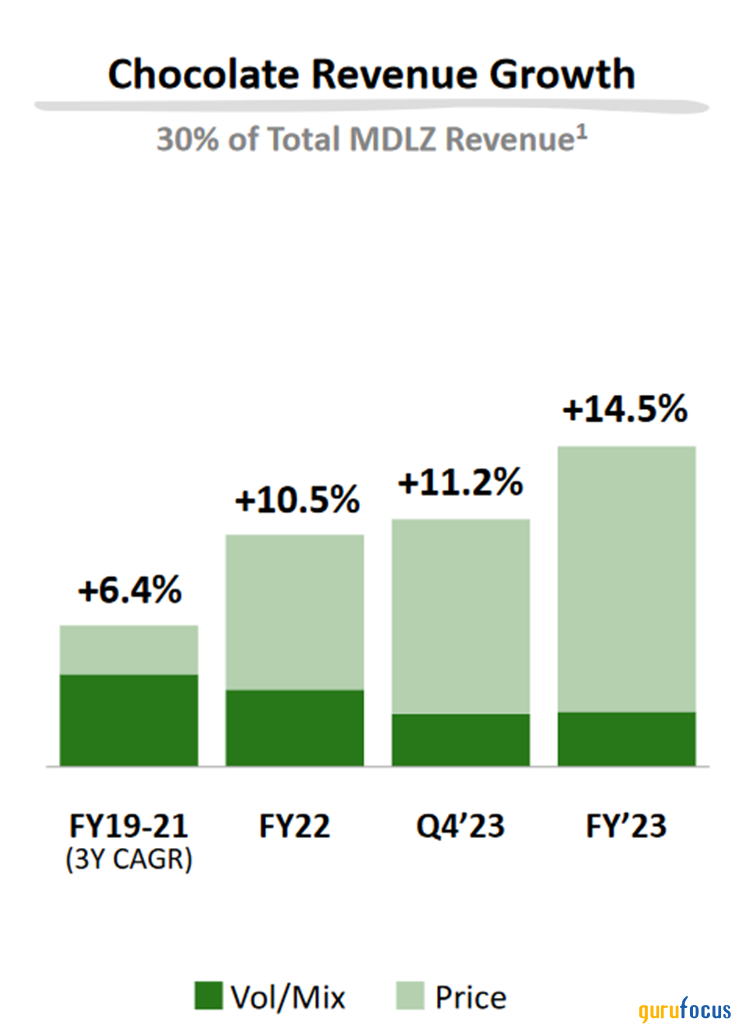

Investors have gotten nervous about holding shares of confectioners, especially Mondelez International (NASDAQ:MDLZ) and Hershey Company (NYSE:HSY). Revenue of Oreo, Cadbury, Milka and Toblerone exceeded $36 billion in 2023, with 30% coming from the chocolate business. Sales of Hershey, which has positioned itself as an industry leader in the U.S., reached $11.20 billion in 2023 (up 7% year over year).

Market reaction

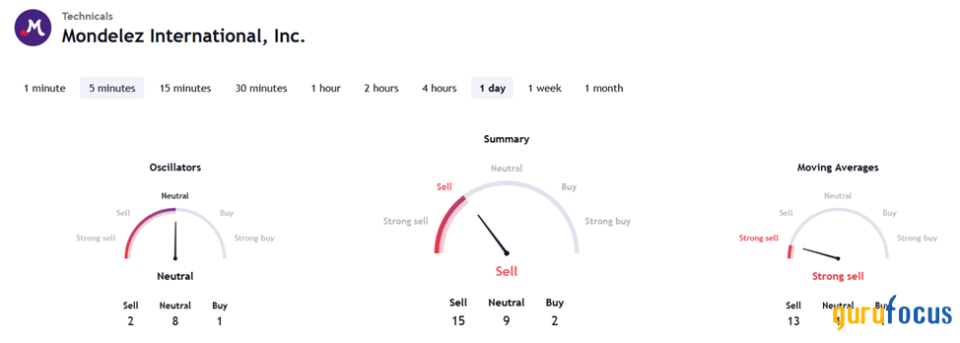

Mondelez shares traded around $77 in February, its six-month high, followed by a two-month decline. The stock has now plunged to a three-month low, touching the support level at $69. Our stop-out at the level of $70 has been reached. The technical picture is negative, with the indicators pointing to a further correction and signaling a strong sell.

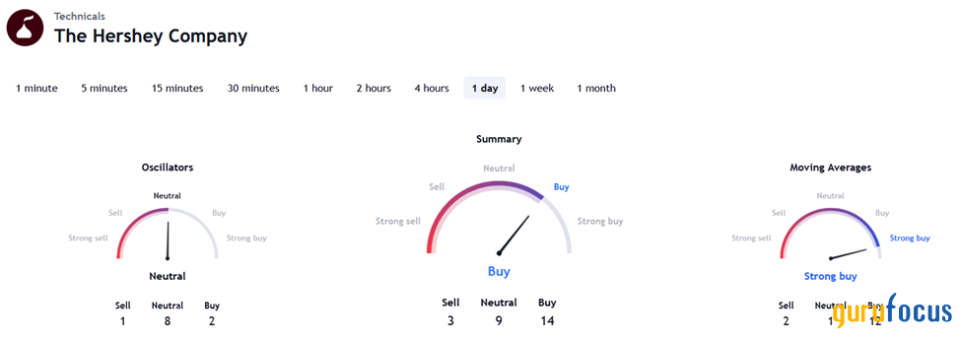

Hershey stock has better indicator patterns. ?

There is no strong trend. The stock is trading 70% below last year's high, but does not look too oversold. There are no technical and fundamental drivers for growth.

How much could confectioners earn?

Mondelez has not disclosed its cost composition of output. In fourth-quarter 2023, when cocoa futures traded at an annual high, cost of goods was 62% of sales, up 4% year over year. Revenue growth was 7%. Chocolate segment revenue is only 30% of total sales. Cocoa does not account for 100% of the cost of production in this segment, and its share in the total cost of production is probably below 20%.

The company's gross margin was 37.30% in the fourth quarter of 2023. Hershey also has not disclosed its cost composition of chocolate output. Its cost of sales was 55% of total revenue in 2023, and the gross margin was 45% (up 2 percentage points year over year). Among the reasons for the increase in production costs, cocoa price growth was mentioned in the context of unfavorable futures prices. Another factor was labor inflation in the supply chain. However, it was pointed out the rising prices have lowered the impact on margins.

We expect the moderate impact on confectioner's operating margins about 2 percentage points. The impact of this factor on net income will be more pronounced, being dependent on the hedge gain. Earnings per share consensus projects growth of 7% and 4% year over year for Mondelez and Hershey, respectively.

What can confectioners do about it?

Despite the apparent vulnerability of manufacturers, they have an impressive arsenal of defenses that will help them not just stay afloat, but emerge with new achievements.

Price hedging

In 2022, Mondelez reported $187 million from commodity price hedging and $552 million in 2021. The 2023 statements are not out yet. This year, the gain from the revaluation of futures could be substantial, partially covering the loss from the increase in cocoa exchange prices. Hershey reported $59 million in derivatives gains.

Sales price increase

Mondelez pointed out that a strong driver of revenue growth in the chocolate segment came from an increase in prices in 2023, the largest in four years.

Consumer demand for chocolate is stable, so suppliers and retailers can increase prices without a large risk of a sales dip. Industry representatives indicated that 60% to 70% of consumers are not ready to give up chocolates and even agree to pay more for their daily sweets.

Playing with volume

It is impossible to reduce the cocoa content in dark chocolate, but it is possible to reduce the production of expensive bitter chocolate with cocoa content from 65% to 99% and to increase the production of milk chocolate, where the share of cocoa does not exceed 25%.

But perhaps the main trick, well mastered by manufacturers back in the period of high inflation after the pandemic, was so-called shrinkflation, or reducing the size of the package. Toblerone, Milka and other chocolates are available in mini and micro packs. Over time, as consumers get used to the new prices, the packaging will get bigger. Given the inelasticity of demand, consumers prefer to buy 10% to 15% less of a product at the usual price than to give it up altogether.

Market trading

Although the acceleration of the futures price is significant, it does not mean that manufactures pay it all. The main volumes of raw materials were held at prices significantly lower than the current ones at $5,000 to $5,500 per ton. Major players in the industry, most likely, bought futures in advance, so the March surge in quotations did not affect them to a great extent. The small producers who expected a correction and planned to buy goods closer to the expiration date suffered as well as those who held short positions.

Price control

The leading manufacturers are large players; they control wholesale and retail prices. Even in the event of a marked increase in production costs next year, manufacturers will retain their ability to keep chocolate prices high by buying commodity futures in advance.

Supply chain management

Although cocoa is crucial for the confectionery business, Hershey and Mondelez did not report high supply failure risks amid price increases in the second half of 2023. Hershey said that in case of difficulties at some suppliers, the shortage will be covered by others. The buffer will be the existing global supplies (their size is not specified). In other words, the crisis will be faced by the smaller players, while the leading manufacturers will still be in good shape due to the well-established chain of business relations.

So is everything still OK?

It apparently is. Global production will fall back to 2017 levels, but after a short-term shock, the market will adapt to the situation. This process will be smoother if the deficit ends up being less than 400,000 tons, and large players manage to take advantage of the existing supplies. As soon as the price shock passes, traders will resume buying shares of chocolate producers. The reason, most likely, will be a favorable technical picture. Mondelez shares, in my opinion, will find support in the range of $64 to $66, and Hershey will start growing to the nearest target of $210 from the current levels.

This article first appeared on GuruFocus.