Should You Buy the Vanguard S&P 500 ETF Right Now or Wait for a Stock Market Correction?

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is one of the best ways to invest in the S&P 500, which has been a pretty smart strategy over the long term. Since 1965, the S&P 500 has produced a total return of 10.2% annualized. The Vanguard ETF has an expense ratio of just 0.03%, so you get to keep most of your gains.

While there's no guarantee that the S&P 500 will achieve the same level of performance in the future, it has historically produced 9%-10% annualized returns over most multidecade periods. Having said that, the S&P 500 isn't too far from its all-time high (as of this writing), so it's natural for investors to wonder whether now might be a good time to buy shares in an S&P 500 index fund or if it would be smarter to wait for a better opportunity.

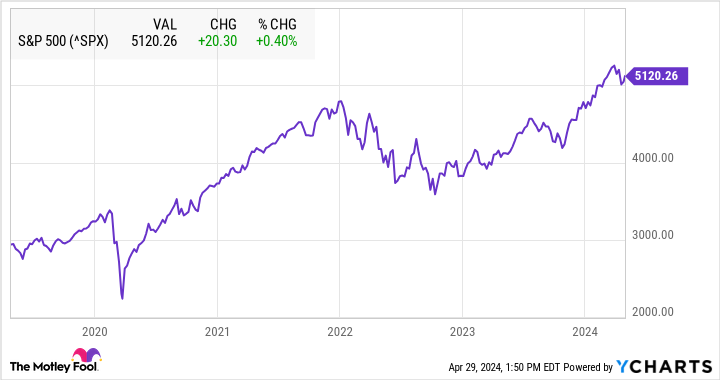

Just under an all-time high

The S&P 500 and several other major stock indices have reached all-time highs this year and remain close to record levels. In the case of the S&P 500, the index is less than 3% below its all-time high, as of April 29.

Should you wait for a correction?

One important thing for all investors to learn is that timing the market is impossible. And quite frankly, it's unimportant if you're investing in a high-quality S&P 500 index fund for the long term. Even if you buy at a market peak, your long-term returns should likely be excellent.

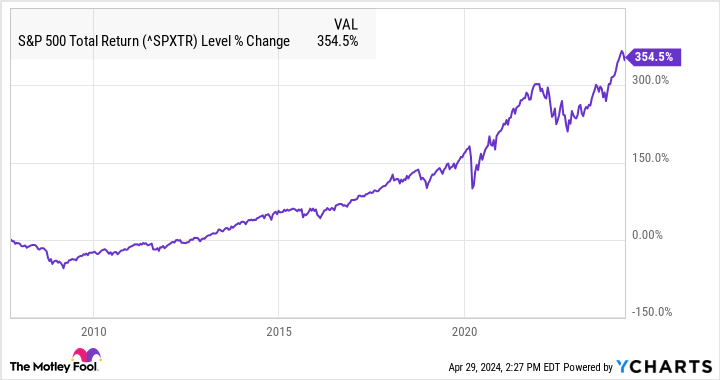

For example, let's say you invested in the S&P 500 at its peak in 2007 -- just before the financial crisis sent the market plunging. By the time the S&P 500 bottomed in early 2009, it had lost about 50%. So this would seem like a pretty awful time to invest.

However, you might be surprised to learn that if you had invested in an S&P 500 index fund at the worst possible time before the 2008-2009 financial crisis, you would be sitting on a 355% total return today. If you look at the chart below, the actual 2008-2009 stock market crash barely looks like a blip over the long run. And that's the point.

It's also worth noting that just because the S&P 500 is near an all-time high doesn't mean it can't go even higher. Many people were "waiting for a correction" in the 2014-2015 time frame after a long post-financial crisis rally and never got one.

A better strategy

Having said that, the best way to invest in S&P 500 ETFs is a little at a time, not all at once.

One excellent strategy is to invest equal amounts of money at certain intervals. This is known as dollar-cost averaging, and mathematically, it guarantees that you'll buy more shares when prices are lower and fewer shares when prices are high.

As a basic illustration of this, let's say you plan to invest $1,000 in the Vanguard S&P 500 index fund every three months. Right now, the fund is trading for approximately $470 per share, so assuming your broker allows you to buy fractional shares, you'd buy 2.13 shares of the index fund.

Now let's say that a market correction comes, and the share price of the fund falls to $430 by the time you're ready to make another investment. This time, your $1,000 investment will buy 2.33 shares.

The bottom line is that by averaging into a fund like the Vanguard S&P 500 ETF, you're going to get a favorable average share price over time. A strategy like this is a far better way to invest than trying to decide whether to invest a lump sum now or later.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $529,390!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Matt Frankel has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Should You Buy the Vanguard S&P 500 ETF Right Now or Wait for a Stock Market Correction? was originally published by The Motley Fool