Bill Nygren of Oak Mark Fund Invests in Citigroup and Ally Financial

- By James Li

During the first quarter, Bill Nygren (Trades, Portfolio) of Oak Mark Fund increased his position in Ally Financial Inc. (ALLY) by 49.90%, ending with 15,674,000 shares of the stock.

Warning! GuruFocus has detected 1 Warning Sign with C. Click here to check it out.

The intrinsic value of C

Usually, the Oak Mark Fund portfolio manager uses multiple methods to calculate the proper intrinsic value for the stock. According to his first-quarter commentary, Nygren wants to apply the valuation metrics that most accurately capture the intrinsic value. For example, Nygren valued Amazon (AMZN), one of his largest holdings last year, using EV/Sales multiples, the valuation multiple that gives Nygren confidence that Amazon was cheap compared to its competitors. For Alphabet Inc. (GOOGL), Nygren used a more complicated approach to value the company: a asum-of-the-partsa approach that explicitly valued cash and cumulative investments in venture caplike projects.

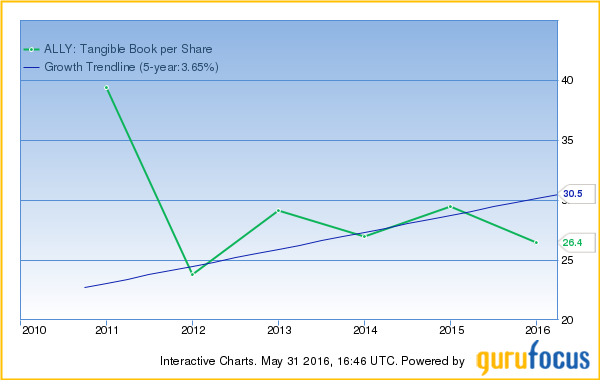

When Nygren buys a companyas stock, he sets a sell target based on his valuation for that company. In order to maximize the return on investment on a stock, Oak Mark Fund buys stocks that appear to be cheaper than other stocks in the industry based on their valuations. The above chart shows Ally Financialas tangible book value per share. For financial companies, the book value usually measures the companyas economic value better than other values since the assets can be reported as the current value of the assets owned. According to the calculations, the tangible book value of Ally Financial is $27.17 per share, which is greater than the companyas current pre-share price of $17.85. Furthermore, Ally Financial has a lower P/B ratio than its competitors, and its current P/B ratio is near three-year lows.

Ally Financial, a financial services company that engages in dealer financial services and mortgages, has a financial strength of 4 out of 10, indicating that the company has a moderately weak financial system. Despite the low operating and net margins, Ally Financial has high three-year EBITDA and EPS growth. The firmas current three-year EBITDA growth is higher than 87% of firms in the global specialty finance industry. With a three-year EPS growth of 73.80, Ally Financial has a higher EPS growth than 96% of firms in its industry.

On May 4, Ally Financial CEO Jeffrey Jonathan Brown bought 12,000 shares of the companyas stock at an average price of $16.81. The total transaction cost is about $201,720. The CEOas purchase of the companyas stock was the largest of three insider purchases on that day.

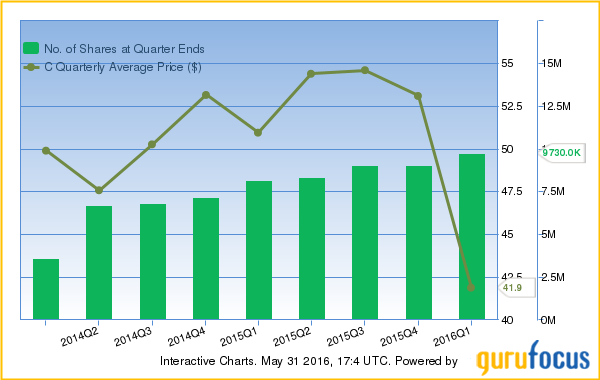

Nygren gradually increased his position in Citigroup Inc. (NYSE:C) each quarter since 2014. As of March 31, Citigroup represents Nygrenas third-largest holding, after General Electric Co. (GE) and Bank of America (BAC). After initially purchasing 3.6 million shares during the first quarter of 2014, Nygren currently owns 9.73 million shares that were purchased at an average price of $49.24. Although financials and materials were the worst contributors to Nygrenas portfolio in the past quarter, the portfolio manager anticipated an upward trend on Citigroupas stock price based on his valuation metrics. Like Ally Financial, Citigroup is also a financial services holding company, and thus the tangible book value per share measures the companyas economic value better than other asset values do. Citigroupas tangible book value per share was $62.07 as of March 31, 2016, which represents an upside of about 32% based on Citigroupas current stock price.

With a financial strength of 6 out of 10, Citigroup has a better financial outlook than does Ally Financial. Citigroupas cash to debt ratio, although it is less than 69% of stocks in the global banking industry, is better than Ally Financialas cash to debt ratio (0.67 for Citigroup compared to just 0.07 for Ally Financial). In addition, Citigroupas equity to asset ratio is higher than 77% of stocks in its sector. Most gurus prefer Citigroup to Ally Financial likely because Citigroup is a larger company and identified as a systematically important financial institution by the Federal Reserve.

For more financial stocks like Citigroup and Ally Financial, you can screen for stocks using the Gurufocus All-in-one Screener: for example, screen for stocks in the global banking industry whose P/B ratios are less than 0.8.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with C. Click here to check it out.

The intrinsic value of C