Best Cheap Stocks To Buy Now

Companies that are recently trading at a market price lower than their real values include Jilin Province Huinan Changlong Bio-pharmacy and Bank of Jinzhou. Smart investors can make money from this discrepancy by buying these shares, because they believe the current market prices will eventually move towards their true value. If you’re looking for capital gains in your next investment, I suggest you take a look at my list of potentially undervalued stocks.

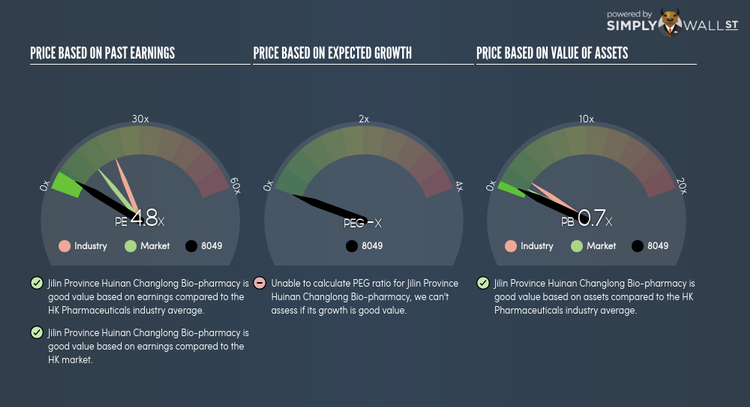

Jilin Province Huinan Changlong Bio-pharmacy Company Limited (SEHK:8049)

Jilin Province Huinan Changlong Bio-pharmacy Company Limited manufactures and distributes Chinese medicines and pharmaceutical products in the People’s Republic of China. Formed in 1989, and currently run by Hong Zhang, the company provides employment to 665 people and with the market cap of HKD HK$862.79M, it falls under the small-cap stocks category.

8049’s shares are now hovering at around -65% below its actual value of ¥4.34, at a price of HK$1.54, according to my discounted cash flow model. The mismatch signals a potential chance to invest in 8049 at a discounted price. Also, 8049’s PE ratio stands at around 4.79x compared to its Pharmaceuticals peer level of, 20.74x meaning that relative to its comparable set of companies, 8049’s stock can be bought at a cheaper price. 8049 is also a financially healthy company, with current assets covering liabilities in the near term and over the long run. 8049 also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility. More on Jilin Province Huinan Changlong Bio-pharmacy here.

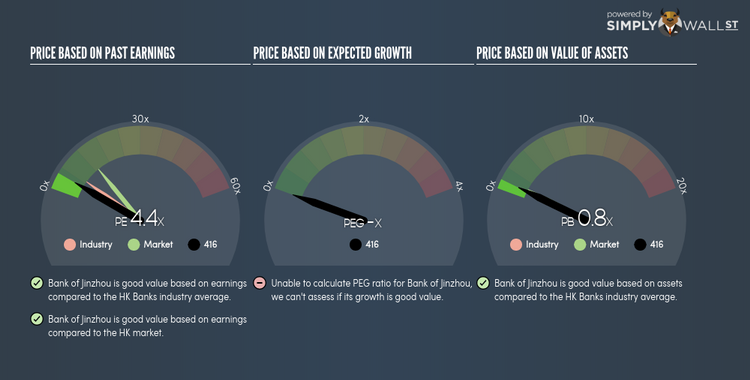

Bank of Jinzhou Co., Ltd. (SEHK:416)

Bank of Jinzhou Co., Ltd. provides various banking products and services in the People’s Republic of China. Formed in 1997, and currently run by Hong Liu, the company provides employment to 4,549 people and has a market cap of HKD HK$48.49B, putting it in the large-cap group.

416’s shares are now hovering at around -58% beneath its intrinsic level of ¥17.16, at a price tag of HK$7.15, based on its expected future cash flows. This discrepancy signals a potential opportunity to buy 416 shares at a low price. What’s even more appeal is that 416’s PE ratio is currently around 4.36x compared to its Banks peer level of, 6.77x implying that relative to its comparable company group, we can purchase 416’s shares for cheaper. 416 is also strong in terms of its financial health, with current assets covering liabilities in the near term and over the long run.

Interested in Bank of Jinzhou? Find out more here.

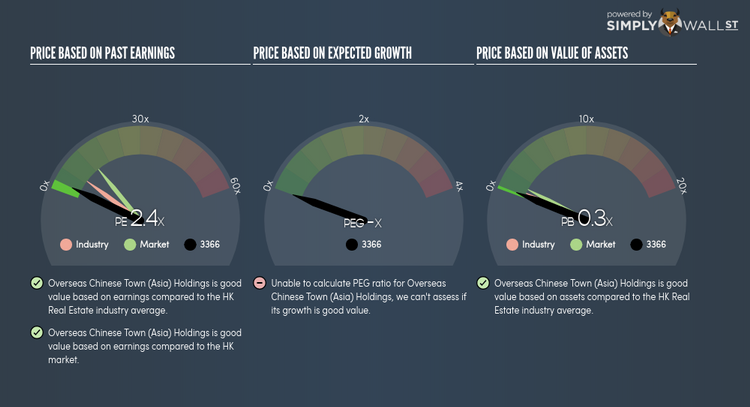

Overseas Chinese Town (Asia) Holdings Limited (SEHK:3366)

Overseas Chinese Town (Asia) Holdings Limited, an investment holding company, primarily develops and operates comprehensive development zone projects in Mainland China and Hong Kong. Started in 1985, and currently run by Mei Xie, the company employs 2,188 people and with the stock’s market cap sitting at HKD HK$3.60B, it comes under the mid-cap category.

3366’s shares are currently trading at -77% under its actual value of ¥21.31, at a price tag of HK$4.81, based on its expected future cash flows. This mismatch signals an opportunity to buy 3366 shares at a discount. What’s even more appeal is that 3366’s PE ratio is currently around 2.44x compared to its Real Estate peer level of, 7.04x meaning that relative to its peers, you can buy 3366’s shares at a cheaper price. 3366 is also a financially robust company, as current assets can cover liabilities in the near term and over the long run. Finally, its debt relative to equity is 48.04%, which has been declining for the past few years indicating 3366’s capability to reduce its debt obligations year on year. Interested in Overseas Chinese Town (Asia) Holdings? Find out more here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.