Australian Dollar Unchanged on Soft China Data, Sequester Looms

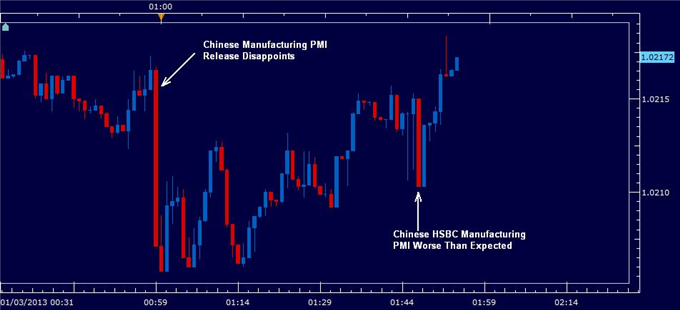

THE TAKEAWAY: The Australian Dollar was largely unchanged against the US Dollar as the Chinese Manufacturing PMI came in at 50.1 which was worse than analyst expectations of 50.5.

Created Using Marketscope 2.0

The Chinese Manufacturing PMI disappointed estimates and came in at 50.1 versus an analyst consensus of 50.5 which continued the downward pressure on the so called “Aussie” which started earlier in the week. The lower than expected HSBC Flash Manufacturing PMI for February released on Monday also saw investors sell their Aussie Dollar holdings as Chinese growth worries surfaced.

Shortly after the Chinese PMI was released, the HSBC Manufacturing PMI also came in worse than expected however the Australian dollar staged a rally against the Greenback. The resistance of the Australian Dollar late this week could be attributed to the looming sequesters budget cuts which could see a delay to the end of quantitative easing which is not good news for the US Dollar.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.