Aptech Limited (NSE:APTECHT): What Does Its Beta Value Mean For Your Portfolio?

If you’re interested in Aptech Limited (NSE:APTECHT), then you might want to consider its beta (a measure of share price volatility) in order to understand how the stock could impact your portfolio. Modern finance theory considers volatility to be a measure of risk, and there are two main types of price volatility. The first category is company specific volatility. This can be dealt with by limiting your exposure to any particular stock. The second sort is caused by the natural volatility of markets, overall. For example, certain macroeconomic events will impact (virtually) all stocks on the market.

Some stocks are more sensitive to general market forces than others. Beta is a widely used metric to measure a stock’s exposure to market risk (volatility). Before we go on, it’s worth noting that Warren Buffett pointed out in his 2014 letter to shareholders that ‘volatility is far from synonymous with risk.’ Having said that, beta can still be rather useful. The first thing to understand about beta is that the beta of the overall market is one. A stock with a beta below one is either less volatile than the market, or more volatile but not corellated with the overall market. In comparison a stock with a beta of over one tends to be move in a similar direction to the market in the long term, but with greater changes in price.

Check out our latest analysis for Aptech

What APTECHT’s beta value tells investors

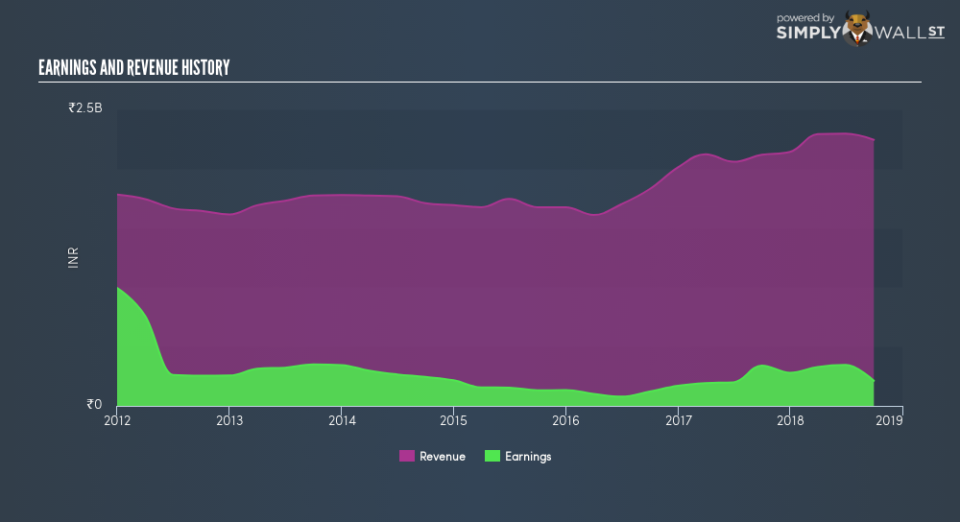

As it happens, Aptech has a five year beta of 1.01. This is fairly close to 1, so the stock has historically shown a somewhat similar level of volatility as the market. While history does not always repeat, this may indicate that the stock price will continue to be exposed to market risk, albeit not overly so. Beta is worth considering, but it’s also important to consider whether Aptech is growing earnings and revenue. You can take a look for yourself, below.

Could APTECHT’s size cause it to be more volatile?

Aptech is a rather small company. It has a market capitalisation of ₹6.8b, which means it is probably under the radar of most investors. It doesn’t take much money to really move the share price of a company as small as this one. That makes it somewhat unusual that it has a beta value so close to the overall market.

What this means for you:

It is probable that there is a link between the share price of Aptech and the broader market, since it has a beta value quite close to one. However, long term investors are generally well served by looking past market volatility and focussing on the underlying development of the business. If that’s your game, metrics such as revenue, earnings and cash flow will be more useful. In order to fully understand whether APTECHT is a good investment for you, we also need to consider important company-specific fundamentals such as Aptech’s financial health and performance track record. I urge you to continue your research by taking a look at the following:

Future Outlook: What are well-informed industry analysts predicting for APTECHT’s future growth? Take a look at our free research report of analyst consensus for APTECHT’s outlook.

Past Track Record: Has APTECHT been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of APTECHT’s historicals for more clarity.

Other Interesting Stocks: It’s worth checking to see how APTECHT measures up against other companies on valuation. You could start with this free list of prospective options.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.