April Best Dividend Payers

Golik Holdings, TCL Multimedia Technology Holdings, and Guangzhou R&F Properties are three of the best paying dividend stocks for creating diversified portfolio income. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. Here are other similar dividend stocks that could be valuable additions to your current holdings.

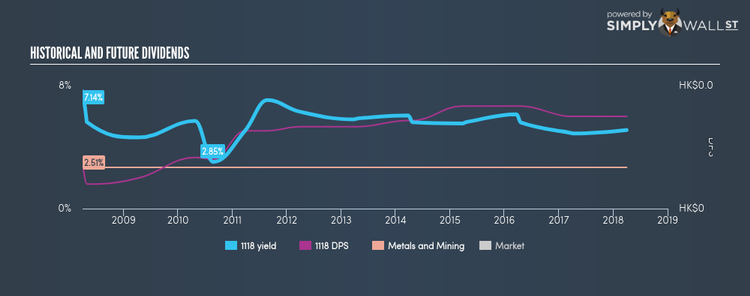

Golik Holdings Limited (SEHK:1118)

Golik Holdings Limited, an investment holding company, manufactures and sells metal products and building construction materials Hong Kong and other regions in the People’s Republic of China. Formed in 1977, and headed by CEO Tak Chung Pang, the company provides employment to 1,452 people and with the company’s market capitalisation at HKD HK$528.21M, we can put it in the small-cap stocks category.

1118 has a sumptuous dividend yield of 4.79% and pays 39.74% of it’s earnings as dividends . 1118’s dividends have increased in the last 10 years, with DPS increasing from HK$0.022 to HK$0.045. Much to the delight of shareholders, the company has not missed a payment during this time. Golik Holdings seems reasonably priced when looking at its PE ratio (12.5). The industry average suggests that HK Metals and Mining companies are more expensive on average 12.9. More detail on Golik Holdings here.

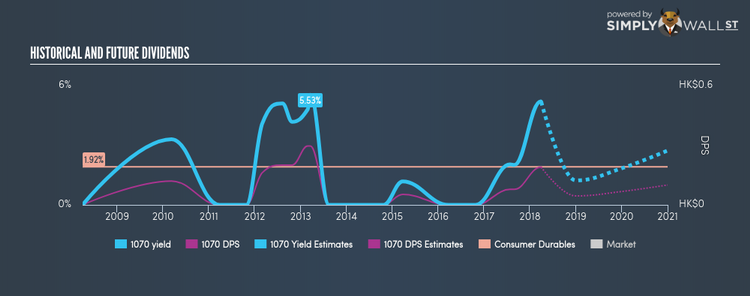

TCL Multimedia Technology Holdings Limited (SEHK:1070)

TCL Multimedia Technology Holdings Limited, an investment holding company, manufactures, distributes, and sells colour television sets in the People’s Republic of China, Europe, North America, and internationally. The company employs 20306 people and with the company’s market cap sitting at HKD HK$8.54B, it falls under the mid-cap stocks category.

1070 has a large dividend yield of 5.18% and their current payout ratio is 8.22% , with an expected payout of 19.23% in three years. Despite there being some hiccups, dividends per share have increased during the past 10 years. More on TCL Multimedia Technology Holdings here.

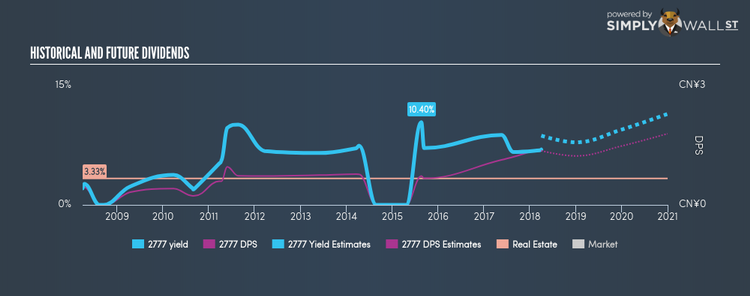

Guangzhou R&F Properties Co., Ltd. (SEHK:2777)

Guangzhou R&F Properties Co., Ltd., together with its subsidiaries, engages in the development and sale of residential and commercial properties primarily in the People’s Republic of China, Malaysia, and Australia. Established in 1994, and now run by Li Zhang, the company now has 49,239 employees and has a market cap of HKD HK$63.09B, putting it in the large-cap stocks category.

2777 has a great dividend yield of 6.96% and is paying out 16.73% of profits as dividends , with analysts expecting a 38.67% payout in the next three years. Despite there being some hiccups, dividends per share have increased during the past 10 years. Guangzhou R&F Properties’s earnings per share growth of 213.60% over the past 12 months outpaced the hk real estate industry’s average growth rate of 43.71%. Dig deeper into Guangzhou R&F Properties here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.