Zooming in on HKG:1292's 5.5% Dividend Yield

Is Changan Minsheng APLL Logistics Co., Ltd. (HKG:1292) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

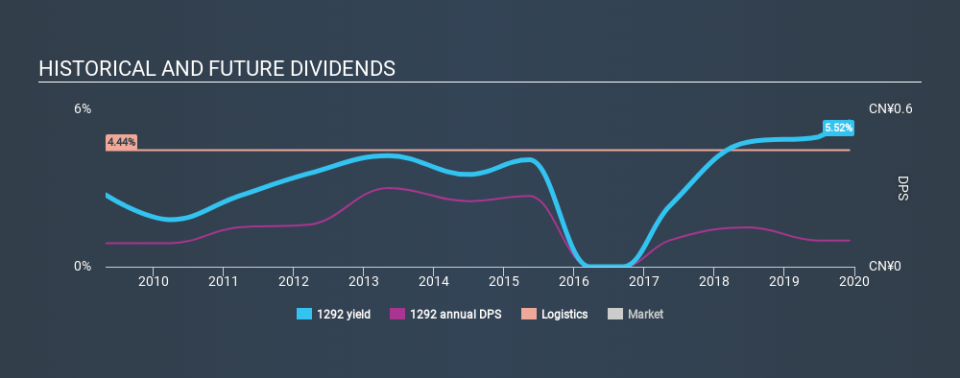

In this case, Changan Minsheng APLL Logistics likely looks attractive to investors, given its 5.5% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Changan Minsheng APLL Logistics paid out 200% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Last year, Changan Minsheng APLL Logistics paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Changan Minsheng APLL Logistics's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Changan Minsheng APLL Logistics's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Changan Minsheng APLL Logistics's dividend payments. Its dividend payments have fallen by 20% or more on at least one occasion over the past ten years. During the past ten-year period, the first annual payment was CN¥0.09 in 2009, compared to CN¥0.10 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.1% a year over that time. The dividends haven't grown at precisely 1.1% every year, but this is a useful way to average out the historical rate of growth.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Changan Minsheng APLL Logistics's earnings per share have shrunk at 48% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Changan Minsheng APLL Logistics's earnings per share, which support the dividend, have been anything but stable.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with Changan Minsheng APLL Logistics paying out a high percentage of both its cashflow and earnings. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. Using these criteria, Changan Minsheng APLL Logistics looks quite suboptimal from a dividend investment perspective.

See if management have their own wealth at stake, by checking insider shareholdings in Changan Minsheng APLL Logistics stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.