Why It Might Not Make Sense To Buy Circle Property Plc (LON:CRC) For Its Upcoming Dividend

Circle Property Plc (LON:CRC) is about to trade ex-dividend in the next four days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Circle Property's shares before the 15th of July in order to receive the dividend, which the company will pay on the 13th of August.

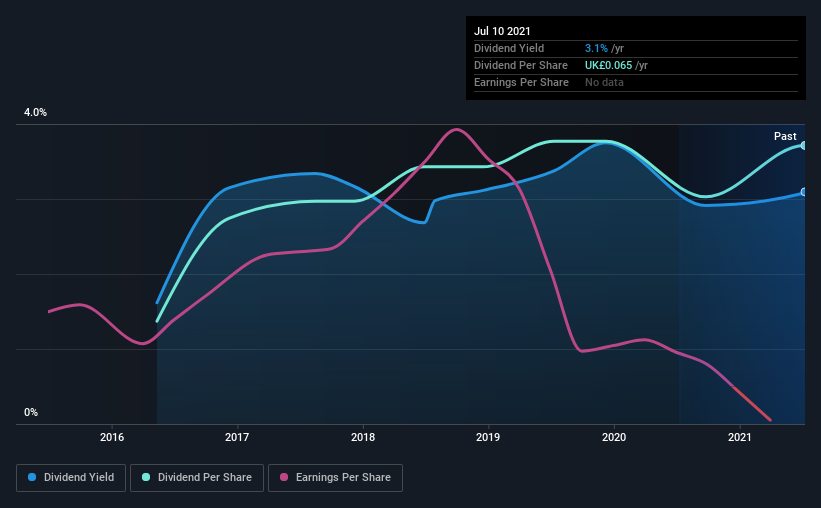

The company's upcoming dividend is UK£0.04 a share, following on from the last 12 months, when the company distributed a total of UK£0.065 per share to shareholders. Looking at the last 12 months of distributions, Circle Property has a trailing yield of approximately 3.1% on its current stock price of £2.1. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Circle Property

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Circle Property reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If Circle Property didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Fortunately, it paid out only 45% of its free cash flow in the past year.

Click here to see how much of its profit Circle Property paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Circle Property reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, five years ago, Circle Property has lifted its dividend by approximately 22% a year on average.

We update our analysis on Circle Property every 24 hours, so you can always get the latest insights on its financial health, here.

Final Takeaway

Is Circle Property worth buying for its dividend? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow." It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that in mind though, if the poor dividend characteristics of Circle Property don't faze you, it's worth being mindful of the risks involved with this business. We've identified 4 warning signs with Circle Property (at least 2 which shouldn't be ignored), and understanding these should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.