Here is Why Apple Inc.'s (NASDAQ:AAPL) Growth Rates Aren't Keeping Up With the Stock

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Apple Inc. (NASDAQ:AAPL) as a stock to avoid entirely with its 29.7x P/E ratio. However, the P/E might be quite high for a reason, and it requires further investigation to determine if it's justified.

Before we start, investors should know that Apple has an outstanding performance in multiple areas, such as cash flows, working capital management, earnings quality, and especially returns.

You can view our detailed report on Apple in order to get a clear picture of the company's fundamentals. You can also read what qualitative factors are impacting Apple's growth here.

Today, will go over the fundamentals of Apple, and see why some investors might like the stock even at a more expensive valuation. Of course, buying a stock at "any" price is slowly building a house of cards, and investors might want to be more patient with their stock picks.

With earnings growth that's superior to most other companies of late, Apple has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue.

If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Apple

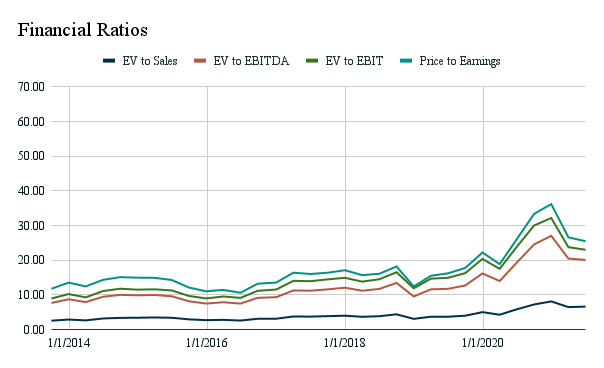

The chart above shows us that the company is valued more expensively than both the market and sector. While the P/E is not preposterous, it might be worth thinking if investor's enthusiasm is justified.

One thing that can help investors with having a clearer picture of a company's future, is to think of a few possible events that can boost and a few that can weaken the stock.

For example, one great catalyst might be the global chip shortage, which will translate in stronger profits for Apple. A negative catalyst might be the recent settlement in the app store related court case.

Investors may also be keen to find out how analysts think Apple's future stacks up against the industry, and can take a look at our free report.

Is There Enough Growth For Apple?

Apple's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 55%. The latest three-year period has also seen an excellent 85% overall rise in EPS, aided by its short-term performance.

Turning to the outlook, the next three years should generate growth of 6.0% each year, as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 12% per year, which is noticeably more attractive.

With this information, we find it concerning that Apple is trading at a P/E higher than the market.

Investors sometimes conflate the love for the company with the future performance of the stock. If we want the best outcome on the market, we must know what is happening to the stock with the cash flows as a foundational basis for our analysis.

In the chart below, there is an important point investors might consider.

We compared the sales and three measures of profit to market valuations. In a healthy market environment, investors can expect that the market adjusts for growth appropriately, and a graph like this would yield relatively consistent horizontal lines.

What we will notice, however, is that after 2018 the market has been less strict with Apple's profits. The pricing of revenue has also deviated, but one can argue that sales growth has been keeping up more with the stock, then earnings growth.

We can also notice, that the market periodically corrects for this. And the more we veer into the future the more volatile the corrections become.

Investors should keep this in mind, and consider that if interested in buying Apple stock, holding it for the long term, might be a better strategy to avoid some volatility.

Conclusion

Apple stock is currently more expensive than the market and sector.

Revenue growth seems to be keeping up with the stock price, however, the company cannot reach the necessary profit growth rates to keep up with the historical benchmark.

To be clear, Apple's growth is still high, but the market seems to be less demanding for cash flows.

Apple is still a solid company with impeccable performance, however the stock is starting to show signs of future short term volatility, and investors may consider longer strategies to offset this.

Alternatively, one can try timing the stock, as it does seem to correct periodically. - This is a risky approach, and investors might not realize potential gains like if they have just entered a position sooner or have a consistent investing scheme.

If you want to find some high quality companies like Apple, explore our interactive list of high quality stocks to get an idea of what else is out there.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com