Weekly Trading Forecast: FX Market Looks to Turn Volatility into Trend Reversals

US Dollar Stands to Gain on Rate Forecast, Surge on Risk Trends

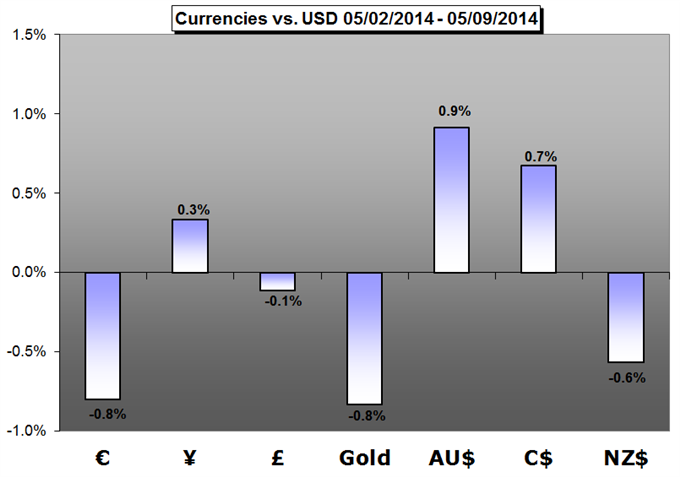

Having started out the period with a painful collapse, the US dollar ended this past week with a strong rally that brought it back to even.

Once Unbreakable, Euro Now Exposed to ECB's Policy Missteps

A serious flaw was exposed in the European Central Bank’s policy strategy this week: with ECB President Mario Draghi saying that the Governing Council felt “comfortable” enacting further dovish policies at the June meeting, there is now a full-blown expectation of a substantive policy change in four weeks. The Euro is already struggling as a result, now that the ECB is backed into a corner.

Japanese Yen Remains a Sell Until this Changes

The Japanese Yen trades at critical resistance versus the US Dollar (USDJPY trades at support). Given extremely low volatility expectations it seems unlikely we see a major USDJPY breakdown, but any major surprises out of upcoming Japanese data could force sharp currency swings.

Gold Prices Vulnerable as USD Regains Footing – All Eyes on US CPI

Gold prices are softer for the second consecutive week with the precious metal off by nearly 1% to trade at $1287 ahead of the New York close on Friday.

Australian Dollar Rebound at Risk on Firming US Economic Data

The Australian Dollar snapped three consecutive weeks of losses but road ahead may prove to be a perilous one as chipper US economic data boosts Fed “taper” continuity bets.

What kind of Forex trader are you? Take our trading survey to find out!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.