Warren Buffett Holds $175 Billion of His Portfolio in 2 Stocks That Could Rise 34% and 17%, According to a Pair of Wall Street Analysts

Shares of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), Warren Buffett's giant conglomerate, have risen by a stunning 4,187,214% since he took the helm of the core business in 1965. If you want to build a portfolio that can grow similarly, you might start by following his lead.

Keeping tabs on what billionaire investors are buying and selling is probably easier than you think. Every three months, Berkshire Hathaway -- and anyone else managing over $100 million -- must submit a 13F filing that discloses their trading activity in the prior quarter to the Securities and Exchange Commission (SEC).

A look at Berkshire Hathaway's first-quarter report revealed that it held $135.4 billion worth of Apple (NASDAQ: AAPL) stock and $39.2 billion worth of Bank of America (NYSE: BAC). These are the two largest positions in Berkshire's equity portfolio, and Wall Street analysts who follow the companies are more than a little bullish about them. Recently updated price targets from a pair of sell-side analysts who follow the businesses suggest their share prices can climb 34% and 17%, respectively, over the next 12 months.

The case for Apple

It didn't start out quite that big, but at the end of December, Berkshire's Apple position was worth a whopping $174.3 billion. Then, in the first quarter, Berkshire sold about 13% of its Apple shares.

Buffett famously buys when the market is fearful and sells when it's over-exuberant. Berkshire's recent sale of some Apple shares implies the market's expectations are higher than they should be, but Daniel Ives, an analyst at Wedbush, disagrees. Ives recently reiterated his outperform rating and $250 price target on Apple shares.

Ives is bullish about Apple because it has been installing advanced chips of its own design in data centers that will handle the processing for AI-powered services. Building superior AI-related services for smartphones and other devices could give Apple's devices a long-term advantage over the competition.

I'd argue that iMessage's lack of accommodation for Android users now is several times more important to Apple's business than any advantage a beefed-up version of Siri might give its devices down the road. Unfortunately for Apple shareholders, green bubble shaming is at the heart of a lawsuit filed in March by the U.S. Department of Justice and 15 states that accuses Apple of abusing its power as a monopoly.

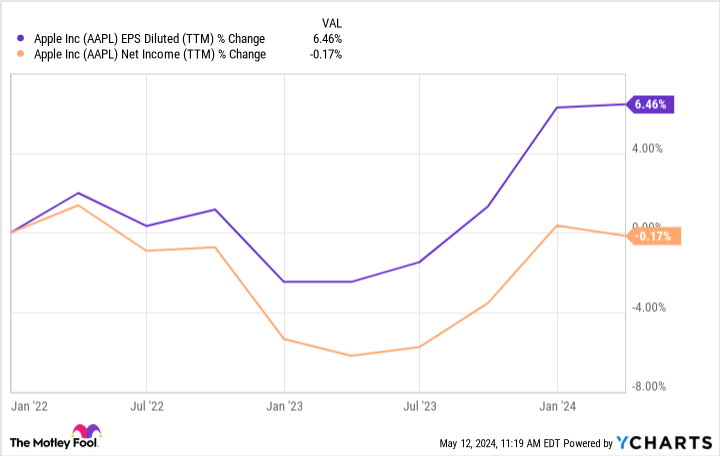

Over the past couple of years, Apple's earnings per share (EPS) have risen slightly, but only because of the company's extensive share repurchases. Trailing-12-month net income has fallen by 0.17% since the beginning of 2022.

Apple is now trading at around 28.5 times its trailing-12-month earnings per share. This is an extremely high price to pay for an already enormous business that has been reporting stagnating profits.

Apple could reach Wedbush's lofty price target, but it isn't a bet I'd recommend to anybody who doesn't have a high risk tolerance. If a revamped Siri bolstered by generative AI features doesn't become a huge growth driver, and if earnings continue to stagnate, investors who buy at current prices could suffer significant losses.

The case for Bank of America

While Berkshire Hathaway trimmed its Apple holdings in the first quarter, its Bank of America position grew in value to $39.2 billion at the end of March from $34.8 billion as of the end of 2023.

Analysts at Oppenheimer most likely agree with Berkshire's decision to hold onto its Bank of America shares. Oppenheimer's sell-side division recently lowered its price target on the stock by $1 to $45 per share -- but it was trading between $38 and $39 on Monday.

Bank of America's excess liquidity and stable profits encouraged Oppenheimer to maintain its outperform rating. The well-capitalized bank finished March with $197 billion in common tier-one equity. That raised its CET1 ratio to 1.84 percentage points above the regulatory minimum.

Bank of America has been a big beneficiary of the higher interest rate environment, and it has been slower than its peers to raise the rates it pays depositors. In the first quarter, net interest income -- the difference between interest paid and interest received -- decreased by just 3% year over year.

At its recent share prices, investors can scoop up Bank of America stock for about 11.9 times forward earnings expectations. At this reasonable valuation, investors should come out way ahead over the long run, even if the bank's profits stagnate. Plus, its dividend yields 2.5% at the current share price. Put it together, and it looks like even risk-averse investors can confidently add some of this bank's shares to their portfolio.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Holds $175 Billion of His Portfolio in 2 Stocks That Could Rise 34% and 17%, According to a Pair of Wall Street Analysts was originally published by The Motley Fool