Want Decades of Passive Income? 2 Stocks to Buy Now and Hold Forever

If you're seeking passive income, you need to think about investing in a slightly different way. Dividends become more important, for sure, but so does a company's ability to keep paying that dividend through thick and thin. On that score, energy giants ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) have proven they are both buy-and-hold stocks for dividend investors.

Exxon and Chevron: The basics

Exxon's dividend yield is around 3.2% today. Chevron's is roughly 3.9%. Looking purely at yield, Chevron is probably the more attractive of the two integrated energy giants right now. Exxon has increased its dividend annually for 42 consecutive years, while Chevron has increased its dividend annually for 37 years running. Both are very respectable streaks and prove that each of these companies clearly cares about returning value to investors via dividends.

These streaks are doubly impressive when you consider that Exxon and Chevron both operate in the energy sector, which is known for being highly volatile. Indeed, oil and natural gas prices are prone to swift and dramatic price swings based on supply and demand, geopolitical events, economic events, and even natural disasters. The pair attempt to ride out the ups and downs of the industry by operating diversified businesses. That includes having operations that span from the upstream (production) through the midstream (pipelines) to the downstream (chemicals and refining). They also have geographic diversification via global asset portfolios.

Before buying either of these companies, you have to understand that revenue and earnings will be volatile because of the impact of energy prices on the top and bottom lines. But, historically speaking, Exxon and Chevron have proven they know how to deal with the swings and that they think long-term, focusing on the entire cycle and not just the current direction of the energy market.

The secret sauce is on the balance sheet

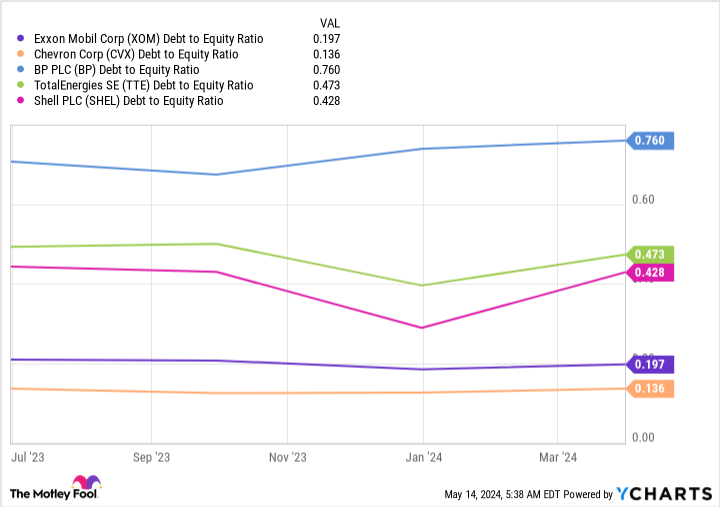

One of the most important aspects of the dividend success Exxon and Chevron have achieved is found on their balance sheets. At the end of the first quarter of 2024, Exxon had a debt-to-equity ratio of roughly 0.2. That's low for any company, let alone an energy company. Chevron's debt-to-equity ratio was even lower at 0.14. The next-closest peer had a debt-to-equity ratio of around 0.4 or so.

Being financially strong is a great thing and it is something that investors should look for in every company they consider buying. But it is doubly important in an industry that is known for its volatility. The deep energy price decline that occurred during the early days of the coronavirus pandemic is perfect proof of this.

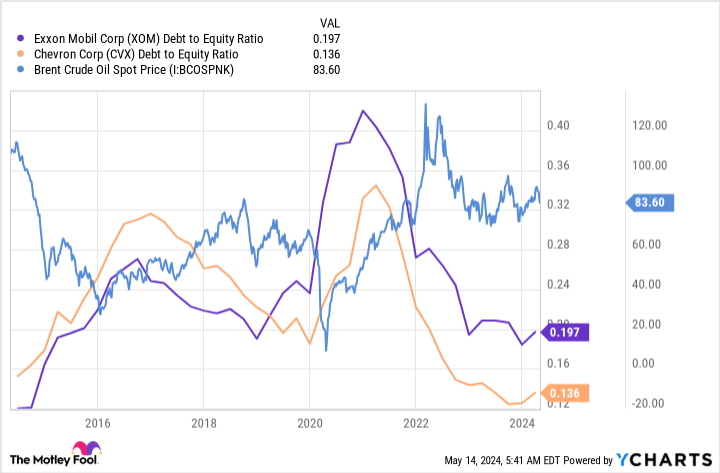

The blue line in the chart above is the price of Brent crude, a key global oil benchmark. Notice that as the price of oil dropped in 2020, which crushed revenue and earnings for energy companies, Exxon and Chevron both increased their leverage. The cash they raised via debt sales was used to fund their businesses during the weak patch and to keep paying dividends to investors. As oil prices recovered, meanwhile, both companies reduced leverage, effectively preparing for the next industry downturn. The key here is that given their low leverage, Exxon and Chevron both have ample room on their balance sheets to endure the low points of the cycle.

The best time to buy?

As noted above, Chevron is probably the more attractive dividend stock right now given its higher yield. That said, if you really want to buy at the "best" time, you should probably wait until the next major oil downturn, when most investors will be indiscriminately selling energy stocks. During those turbulent periods, Exxon and Chevron can yield close to 10%. And, if history is any guide, their long-term strategy has proven they can work through downturns while continuing to pay dividend investors well. But even if you buy today, you can rest easy knowing that these two energy giants know how to handle the industry's big swings.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $578,143!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 2 Stocks to Buy Now and Hold Forever was originally published by The Motley Fool