Volatility 101: Should Chow Tai Fook Jewellery Group (HKG:1929) Shares Have Dropped 22%?

Chow Tai Fook Jewellery Group Limited (HKG:1929) shareholders should be happy to see the share price up 18% in the last quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 22%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for Chow Tai Fook Jewellery Group

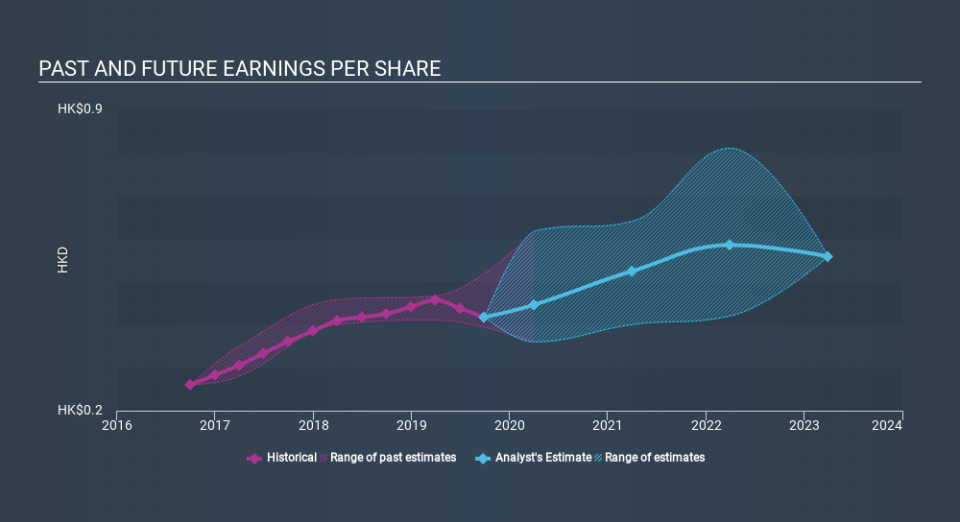

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Chow Tai Fook Jewellery Group's share price and EPS declined; the latter at a rate of 8.4% per year. The share price decline of 4.9% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Chow Tai Fook Jewellery Group's key metrics by checking this interactive graph of Chow Tai Fook Jewellery Group's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Chow Tai Fook Jewellery Group, it has a TSR of 17% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Chow Tai Fook Jewellery Group shareholders have received a total shareholder return of 32% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3.1% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before forming an opinion on Chow Tai Fook Jewellery Group you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.