Virginia National Bankshares Corp (VABK) Reports Decline in Quarterly and Annual Net Income ...

Net Income: Q4 net income decreased to $3.2 million from $7.1 million YOY; annual net income down to $19.3 million from $23.4 million.

Earnings Per Share (EPS): Q4 EPS fell to $0.59 from $1.32 YOY; annual EPS decreased to $3.58 from $4.38.

Loan Growth: Gross loans outstanding increased by 16.7% YOY to $1.1 billion.

Noninterest Expense: Decreased by 10.5% for Q4 and 11.7% annually due to merger efficiencies.

Deposits and Borrowings: Total deposits declined by 4.7% YOY, while borrowings increased by $66.5 million.

Asset Quality: Nonperforming assets remained low at 0.17% of total assets.

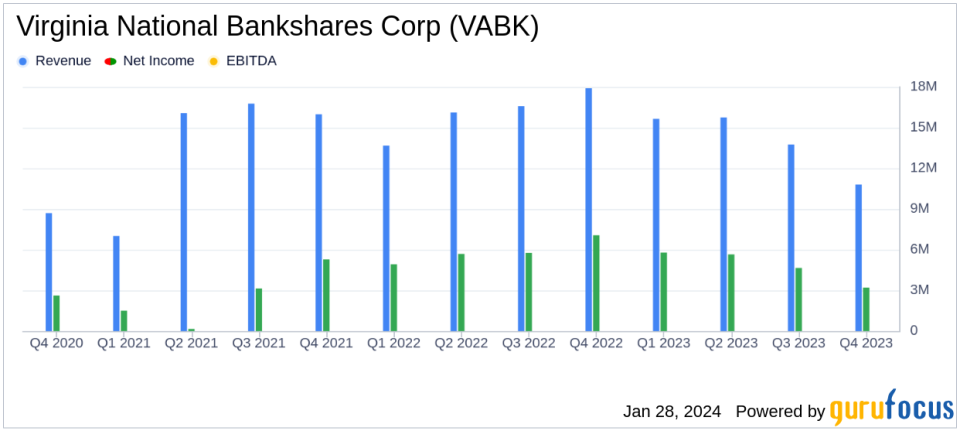

On January 26, 2024, Virginia National Bankshares Corp (NASDAQ:VABK) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The bank holding company, which operates in commercial and retail banking, reported a decrease in net income for both the quarter and the year, despite significant loan growth and effective cost management.

Financial Performance Overview

For the fourth quarter of 2023, VABK reported a net income of $3.2 million, or $0.59 per diluted share, compared to $7.1 million, or $1.32 per diluted share, for the same period in 2022. The annual net income for 2023 was $19.3 million, or $3.58 per diluted share, down from $23.4 million, or $4.38 per diluted share, in the previous year. This decline in profitability was partly offset by a 16.7% year-over-year increase in gross loans outstanding, which totaled $1.1 billion.

The company's yield on loans improved, reaching 5.47% for the quarter and 5.72% for the year, up from 5.00% and 4.52% respectively in the prior year. Credit performance remained robust with nonperforming assets constituting only 0.17% of total assets as of December 31, 2023.

Cost Management and Efficiency Gains

Noninterest expense for the quarter decreased by $977 thousand, or 10.5%, compared to the same period in 2022, reflecting the ongoing benefits of the company's merger-related efficiencies. These included reduced headcount, lower occupancy costs from branch network optimization, and decreased professional fees.

However, total deposits declined by 4.7% year-over-year as customers sought higher yields elsewhere, prompting the bank to increase its borrowings by $66.5 million. The company's strategy to maintain a low cost of funds during the first quarter of 2023 shifted later in the year to meet customer rate demands, resulting in a 2.8% increase in deposit balances from the third to the fourth quarter.

Asset Quality and Capital Ratios

Asset quality metrics remained strong, with nonperforming assets amounting to $2.7 million as of December 31, 2023, compared to $1.4 million as of December 31, 2022. The allowance for credit losses as a percentage of total loans was 0.77% at the end of 2023, up from 0.59% at the end of 2022.

Book value per share increased to $28.52 as of December 31, 2023, from $25.00 as of December 31, 2022, while tangible book value per share also rose to $26.12 from $22.31 over the same period.

Income Taxes and Dividends

The effective tax rate for the fourth quarter was 16.6%, down from 18.5% in the previous year, benefiting from low-income housing tax credits and tax-exempt income. During the fourth quarter of 2023, cash dividends of $1.8 million, or $0.33 per share, were declared and paid.

In conclusion, VABK's earnings report reflects a mixed financial performance with strong loan growth and cost management, but also a decline in net income and earnings per share. The company's strategic adjustments in response to changing market conditions and its solid asset quality position it to navigate the challenges ahead.

For a detailed analysis of VABK's financial results, including reconciliations of non-GAAP financial measures, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Virginia National Bankshares Corp for further details.

This article first appeared on GuruFocus.