US Dollar Technical Analysis: Pausing to Digest Losses

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

US Dollar Technical Strategy: Holding Long via Mirror Trader Basket **

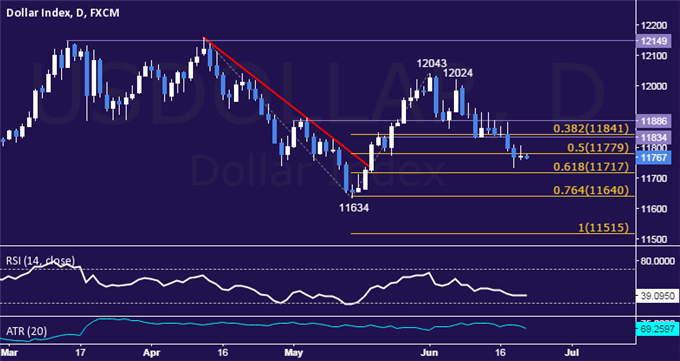

Support: 11717, 11634, 11515

Resistance: 11779, 11841, 11886

The Dow Jones FXCM US Dollar Index paused to consolidate after breaking range support following last week’s FOMC-inspired losses. Near-term support is at 11717, the 61.8% Fibonacci expansion, with a break below that on a daily closing basis exposing the 11634-40 zone (May 14 low, 76.4% level). Alternatively, a move above the 50% Fib at 11779 opens the door for a challenge of the 11834-41 area (horizontal pivot, 38.2% expansion).

Our long-term fundamental outlook calls for a broadly stronger US Dollar against its major currency counterparts. With that in mind, we are holding long via the Mirror Trader US Dollar currency basket.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

** The Dow Jones FXCM US Dollar Index and the Mirror Trader USD basket are not the same product.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.