US Dollar Falters, S&P 500 Flirts with Downside Breakout

THE TAKEAWAY: The US Dollar failed to sustain upward momentum as expected, sinking to probe key support, while the S&P 500 may have produced a downside breakout.

Capitalize on Shifts in Market Mood with the DailyFX Speculative Sentiment Index.

US DOLLAR TECHNICAL ANALYSIS– A recovery from channel support proved short-lived as expected, with prices now testing below the formation bottom (10791) to challenge the 23.6% Fibonacci retracement at 10764. A break below that exposes the 38.2% level at 10694. Channel resistance is now at 10882.

Daily Chart - Created Using FXCM Marketscope 2.0

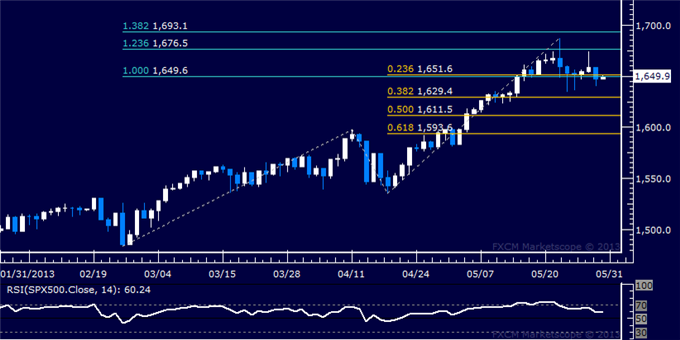

S&P 500 TECHNICAL ANALYSIS – Prices edged below support in the 1649.60-51.60 area, marked by the 23.6% Fibonacci retracement and the 100% expansion. Sellers now aim to challenge the 38.2% level at 1629.40. Alternatively, a move back above 1651.60 targets the 123.6% expansion at 1676.50.

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS – Prices completed a Bullish Engulfing candlestick pattern above support at 1348.97, the 38.2% Fibonacci retracement level, hinting at gains ahead. Initial resistance is at 1402.11, the 23.6% level, with a break above that targeting the 14.6% Fib at 1434.86 and the May 3 high at 1488.00. Alternatively, a move below support eyes the 50% expansion at 1306.02.

Daily Chart - Created Using FXCM Marketscope 2.0

CRUDE OIL TECHNICAL ANALYSIS– Prices followed the formation of a bearish Dark Cloud Cover candlestick pattern with the completion of what appears to be a Head and Shoulders topping chart formation. The break below support at 93.34 exposes the next downside barrier at 92.11. The H&S setup broadly implies a measured downside objective at 90.05. The 93.34 level has been recast as near-term resistance, with a move back above that eyeing the May 28 high at 95.89.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

New to FX? Watch this Video. For live market updates, visit the Real Time News Feed

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.