What Type Of Shareholder Owns Argent Minerals Limited’s (ASX:ARD)?

A look at the shareholders of Argent Minerals Limited (ASX:ARD) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Warren Buffett said that he likes ‘a business with enduring competitive advantages that is run by able and owner-oriented people’. So it’s nice to see some insider ownership, because it may suggest that management is owner-oriented.

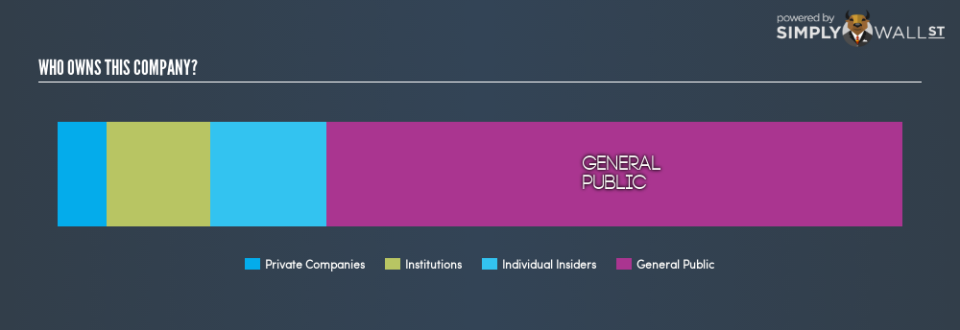

With a market capitalization of AU$6.6m, Argent Minerals is a small cap stock, so it might not be well known by many institutional investors. Taking a look at the our data on the ownership groups (below), it’s seems that institutions own shares in the company. Let’s take a closer look to see what the different types of shareholder can tell us about ARD.

Check out our latest analysis for Argent Minerals

What Does The Institutional Ownership Tell Us About Argent Minerals?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

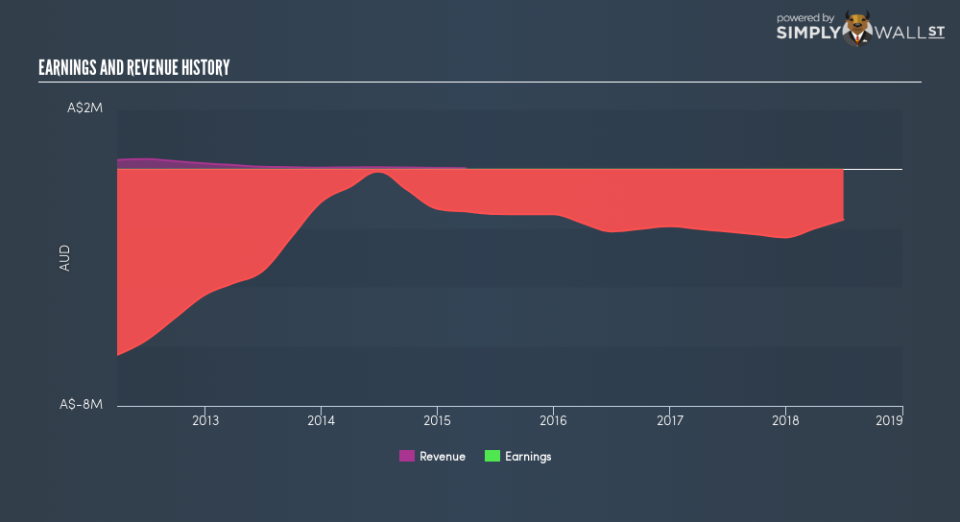

As you can see, institutional investors own 12% of Argent Minerals. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It’s therefore worth looking at Argent Minerals’s earnings history, below. Of course, the future is what really matters.

We note that hedge funds don’t have a meaningful investment in Argent Minerals. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Argent Minerals

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Argent Minerals Limited. It has a market capitalization of just AU$6.6m, and insiders have AU$903k worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public — mostly retail investors — own 68% of Argent Minerals . This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

Our data indicates that Private Companies hold 5.9%, of the company’s shares. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it’s hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free .

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.