Those Who Purchased Bank of East Asia (HKG:23) Shares A Year Ago Have A 22% Loss To Show For It

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the The Bank of East Asia, Limited (HKG:23) share price slid 22% over twelve months. That's well bellow the market return of -2.6%. At least the damage isn't so bad if you look at the last three years, since the stock is down 12% in that time.

Check out our latest analysis for Bank of East Asia

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Bank of East Asia share price fell, it actually saw its earnings per share (EPS) improve by 22%. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

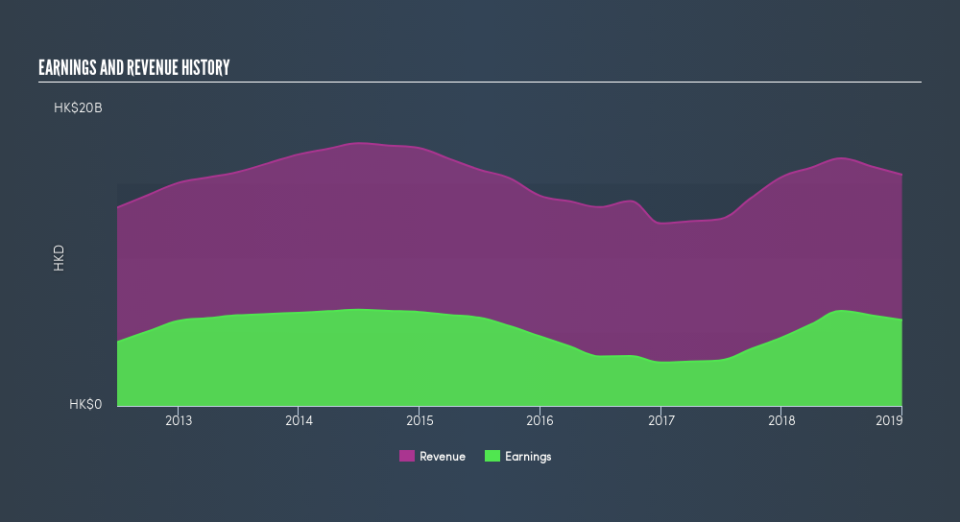

Revenue was pretty flat on last year, which isn't too bad. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Bank of East Asia is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Bank of East Asia's TSR for the last year was -19%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Bank of East Asia shareholders are down 19% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 2.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.1% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on Bank of East Asia you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.