Think About Your Trade Size Like A Pro

“Even unlikely events must come to pass eventually. Therefore, anyone who accepts a small risk of losing everything will lose everything, sooner or later. The ultimate compound return rate is acutely sensitive to fat tails.”

-William Poundstone, Fortune’s Formula

“Any good investment, sufficiently leveraged, can lead to ruin.”

-Edward Thorp, Old Pros Size up the Game, Wall Street Journal

Talking Points:

As a Trader, You should be concerned with Survival over Instant Wealth

Manage the unmanageable with your trade size

Why the 2% rule has stood the test of time

Theory of Runs encourages you to limit exposure

Before you become a trader, you likely often thought that if you could just figure out a decent entry system then you should be well on your way to hitting your trading goals. However, when your money is in the account and you’re looking for a trade, you’re faced with a large part of thediscretionary trader’s dilemmaof trying to grow as wealthy as possible as quick as possible or trying to grow your account with a limited amount of risk.

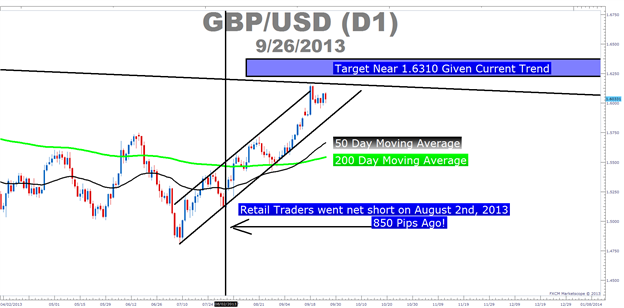

Learn Forex: Even If You Think Your Trade Is Going to the Moon, Limit Your Trade Size

(Created from FXCM Marketscope 2.0)

You should be concerned with Survival over Instant Wealth

There is a great quote in the seminal book, Market Wizards when Jack Schwager interviews Hedge Fund Manager Larry Hite who simply says, “If you don't bet, you can't win. If you lose all your chips, you can't bet.” (Emphasis mine). This quip should alert you that if you talk to fund managers or long term traders, they’ll likely focus more about their money management program than their signals. Quite simply, this is because they know that the market will definitely move but are smart enough to tell you that they would never bet all their money on which way it is expected to move.

Instead of focusing only on the best indicator, professional traders and money mangers know that what will allow them to raise the next million or billion to manage is by showing prospective investors that their losses have been kept under control through thick and thin. I recommend that you trade like you hope to one day raise capital to manage and think about the fact that traders want to know two things. Did you make money and if so and they’re still in your presence, were you able to pull off this feat without risking your entire bankroll?

Manage the unmanageable with your trade size

Another concept that may be helpful to wrap your mind around is that trade size is the ultimate insurance as a trader. In other words, even you make the worst trade imaginable and buy at the top only to sell at the bottom your trade size will determine the relative amount of pain you will feel from your poor entry. Therefore, even though the market is full of opportunity that appears endless, it is still helpful to control your risk and exposure with your trade size because in the end you don’t know exactly where the market will end tomorrow even though you have an edge via a technical trading strategy or other tool.

The Theory of Runs & The reason the 2%-5% rule has stood the test of time

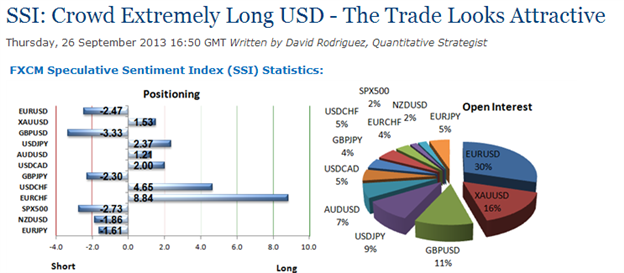

One of our best tools that can keep you humble in your trading is the Speculative Sentiment Index.The SSI shows you how many traders are loaded up on one side of the trade which all too often is against the overall trend. This is quite disappointing but it’s key to understanding that traders have an internal desire to sell high even if the trade continues going higher.

Learn Forex: Traders Often Push Their Luck against the Overall Trend

Courtesy of DailyFX Plus SSI

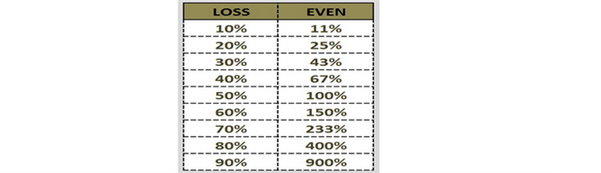

Take a moment and think on this question for a moment. Given your most common trade size in relation to your current account balance, how much would your account be down if you had 5 or maybe even 10 consecutive losses. This question is based on the Theory of negative runs as a mental exercise and if the answer is that your account would be down by greater than 20%, then you may need to be limiting your trade size.

Please note, limiting your trade size doesn’t mean you’re a bad trader. On the contrary, limiting your trade size means that accept in advance that you don’t know exactly how the trade will turn out and you’re being proactive in making sure that you’re around for the next trade next week, month, or year. To recap the introducing quote to this article, “Any good investment, sufficiently leveraged, can lead to ruin.”

Lastly, I’ll leave you with this helpful chart that shows you why you should limit not only your trade size but your losses. Large losses leave you with a daunting task ahead of attempting to break even before you can break ahead. The best way to get an edge is to do so in terms of trade size so that you’re not playing the game at a distinct disadvantage of having to recoup major losses.

---Written by Tyler Yell, Trading Instructor

To contact Tyler, emailtyell@dailyfx.com.

To be added to Tyler’s e-mail distribution list,please click here.

New to the FX market? Save hours in figuring out what FOREX trading is all about.

Take this free 20 minute “New to FX” course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HEREto start your FOREX learning now!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.