We Think Ming Lam Holdings (HKG:1106) Has A Fair Chunk Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Ming Lam Holdings Limited (HKG:1106) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Ming Lam Holdings

What Is Ming Lam Holdings's Debt?

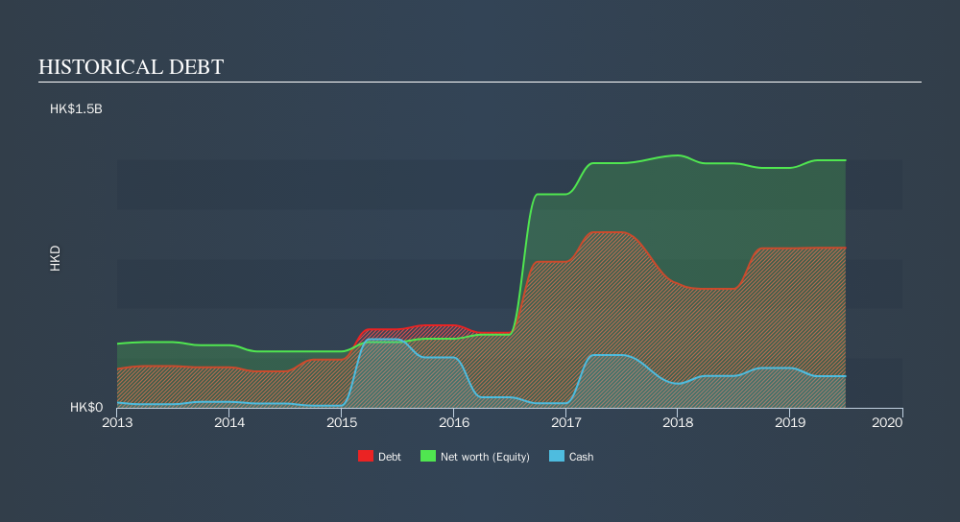

As you can see below, at the end of June 2019, Ming Lam Holdings had HK$803.9m of debt, up from HK$597.9m a year ago. Click the image for more detail. However, because it has a cash reserve of HK$158.8m, its net debt is less, at about HK$645.1m.

How Healthy Is Ming Lam Holdings's Balance Sheet?

The latest balance sheet data shows that Ming Lam Holdings had liabilities of HK$1.01b due within a year, and liabilities of HK$171.7m falling due after that. Offsetting these obligations, it had cash of HK$158.8m as well as receivables valued at HK$1.10b due within 12 months. So it can boast HK$74.0m more liquid assets than total liabilities.

It's good to see that Ming Lam Holdings has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Ming Lam Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Ming Lam Holdings made a loss at the EBIT level, and saw its revenue drop to HK$1.0b, which is a fall of 4.4%. That's not what we would hope to see.

Caveat Emptor

Importantly, Ming Lam Holdings had negative earnings before interest and tax (EBIT), over the last year. Its EBIT loss was a whopping HK$72m. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. But we'd want to see some positive free cashflow before spending much time on trying to understand the stock. So it seems too risky for our taste. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Ming Lam Holdings insider transactions.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.