Target (NYSE:TGT) has Benefited from its Digitization Project in efficacy, but lacks Sustainable Online Growth

This article was originally published on Simply Wall St News

Target Corporation ( NYSE:TGT ) has impressed investors with good total returns, stemming both from dividends and stock price increases. We want to get a clearer picture as to what is behind this trend and is it sustainable in the future. In our analysis, we will look at the performance, competition and some risk factors that Target faces moving forward.

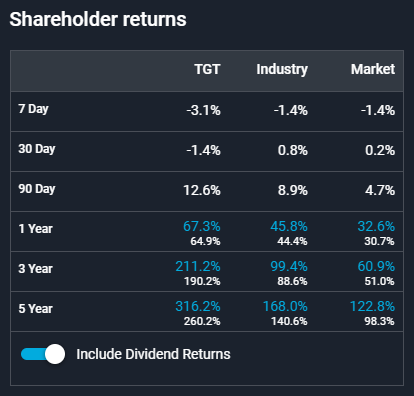

We start with the chart below, which shows the relative performance of Target to the industry and market. As you can see, we are looking at a winner in most of the timeframes.

Business Performance & Strategy

When looking at the fundamentals , we can see that Target has great financial performance in the last few years, as well as a strong last earnings report. A quick overview of their latest report reveals:

Revenue: US$25.2b (up 9.5% from 2Q 2020)

Net income: US$1.82b (up 7.5% from 2Q 2020)

Profit margin: 7.2% (down from 7.4% in 2Q 2020). The decrease in margin was driven by higher expenses

Target's management explains that this is a result of digitalization, continuous assortment updates, store renovations and upgrades. Looking at the bigger picture, Target is transforming itself from an in-store business to a multichannel presence, from which customers can order and get same day delivery via their subsidiary Shipt.

Target's digitalization story started with Google Cloud, and provides multiple marketing and technological benefits for the business. You can read more about Target's digitalization strategy HERE.

The company is focused on same day delivery as part of their digitalization strategy, and starting in 2020, over 50% of their digital sales were driven by same-day fulfillment options: Order Pickup, Drive Up, and delivery via Shipt. That number is expected to keep increasing in the future.

Competition & Risks

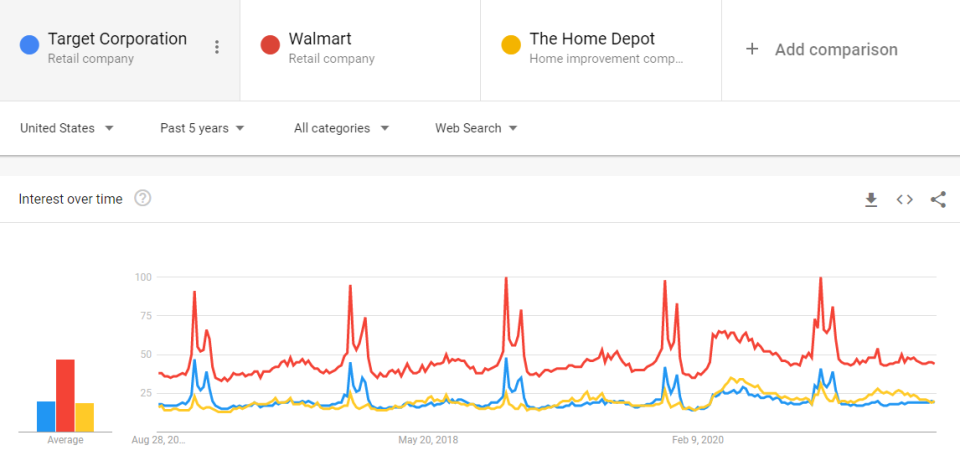

Target also has some heavy competition in popularity, and the way it can continue performing, is either by becoming more profitable with their current clients, or by expanding their reach . A look at the digital search for Target and their competitors reveals some interesting insight:

The results from the Google Trends Query show that Target is lagging behind Walmart ( NYSE:WMT ) on a traditional peer retail basis. When interpreting these results, we should note that the 2 competitors have a different product portfolio, but their common competing grounds are their retail stores.

There are two main takeaways from the graph above:

The retail business is highly seasonal, with an emphasis on Q4 during the holidays and shopping events. This opens up the road to human resource management similarly to supply chain management, which was pioneered by Walmart. HR management, lowers costs of retailers by hiring seasonal workers and contractors in high-demand periods. Something that is now even more available with Target's digitalization program.

The interest of clients does not seem to be increasing on the long term (as far as we can infer from Google Search). This means that the company, will need to propose a concrete growth strategy or continue to increase margins by way of lowering costs and increasing business efficiency. However, the problem with efficacy is that there are only a limited number of costs you can cut, and sooner or later we will have to stop projecting increased cash flows from efficiency.

Additionally, in the last 5 years, the 2 top search queries related to Target were the Nintendo Switch and the PlayStation 5. This showcases an advantage for large retailers : When a highly anticipated product is launched, manufacturers will prioritize retail stores because they can offload a substantial quantity into their storehouses and release the pressure of online supply chains in the launch period. This can tie part of the financial success of Target with new high-demand products, so investors may want to be on the lookout for the launch date of new popular products such as next-gen gaming consoles.

Continuing with competitors of Target, we feel that it is imperative to mention Amazon Inc., ( NASDAQ:AMZN ). Even though Amazon does not focus on traditional retail stores (yet), the company is focused on the consumer, by aggressively outbidding competitors for new and popular items. This limits retailers like Target, leaving them with the residual palette of products which are not the focus of Amazon. This means, that Target may have to focus on a growth strategy that can distinguish itself from the more successful online retailers.

Lastly, we would like to note the supply-side risk. A large portion of Target's merchandise is sourced, directly or indirectly, from outside the U.S., with China being the single largest source. This has an array of implications, especially with the elevated tensions at the moment. If a discrete event leads to supply shortages, then it can be detrimental to the operations of the company for a few quarters. This has a low probability of occurring, but investors may want to be mindful of the downside as well.

Key Takeaways

Target has outperformed the market and industry on a total shareholder return basis in the last 5 years. Their position seems reinforced and justified with the latest Q2 Earnings Report.

Target has advanced digitally, providing online same-day delivery services and becoming more efficient in their operations. The company may find further growth in online retail, but that hasn't begun manifesting, judging from Google Search Trends.

The company is continuously reinvesting, but faces downwards pressures from traditional competitors such as Walmart and the massive online retailer Amazon. Target is committing to pay an increased dividend to shareholders since March 2021, but this suggests the company is satisfied with current growth levels and is finding it harder to find new avenues for growth.

Investors may want to watch the Intrinsic Value of Target closely, and wait for gaps that open more upside in the future.

China is a major supply-side risk, but we also found 2 more risk factors that investors should be aware of.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com