RPMGlobal Holdings Limited (ASX:RUL): What Does It Mean For Your Portfolio?

If you are a shareholder in RPMGlobal Holdings Limited’s (ASX:RUL), or are thinking about investing in the company, knowing how it contributes to the risk and reward profile of your portfolio is important. Every stock in the market is exposed to market risk, which arises from macroeconomic factors such as economic growth and geo-political tussles just to name a few. This is measured by its beta. Not every stock is exposed to the same level of market risk, and the broad market index represents a beta value of one. Any stock with a beta of greater than one is considered more volatile than the market, and those with a beta less than one is generally less volatile.

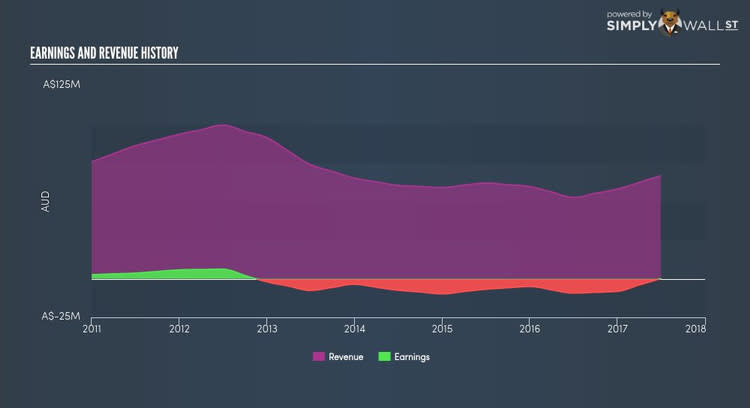

See our latest analysis for RUL

An interpretation of RUL’s beta

RPMGlobal Holdings’s beta of 0.62 indicates that the company is less volatile relative to the diversified market portfolio. The stock will exhibit muted movements in both the downside and upside, in response to changing economic conditions, whereas the general market may move by a lot more. Based on this beta value, RUL appears to be a stock that an investor with a high-beta portfolio would look for to reduce risk exposure to the market.

Could RUL’s size and industry cause it to be more volatile?

RUL, with its market capitalisation of AUD A$164.90M, is a small-cap stock, which generally have higher beta than similar companies of larger size. Furthermore, the company operates in the software industry, which has been found to have high sensitivity to market-wide shocks. As a result, we should expect a high beta for the small-cap RUL but a low beta for the software industry. It seems as though there is an inconsistency in risks portrayed by RUL’s size and industry relative to its actual beta value. There may be a more fundamental driver which can explain this inconsistency, which we will examine below.

Is RUL’s cost structure indicative of a high beta?

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I examine RUL’s ratio of fixed assets to total assets to see whether the company is highly exposed to the risk of this type of constraint. Considering fixed assets account for less than a third of the company’s overall assets, RUL seems to have a smaller dependency on fixed costs to generate revenue. As a result, the company may be less volatile relative to broad market movements, compared to a company of similar size but higher proportion of fixed assets. Similarly, RUL’s beta value conveys the same message.

What this means for you:

Are you a shareholder? You could benefit from lower risk during times of economic decline by holding onto RUL. Its low fixed cost also means that, in terms of operating leverage, it is relatively flexible during times of economic downturns. Consider the stock in terms of your other portfolio holdings, and whether it is worth investing more into RUL. For more company-specific research on RUL, check out our our free analysis plaform here.

Are you a potential investor? You should consider the stock in terms of your portfolio. It could be a valuable addition in times of an economic decline, due to its low fixed cost and low beta. However, I recommend you to also look at its fundamental factors as well, such as its current valuation and financial health to assess its investment thesis in further detail. Continue your research on the stock with our free fundamental research report for RUL here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.