Pool Corp Is a Silent Monster

- By

Pool Corporation's stock price is already trading in the $400's, and many investors seem to overlook the stock these days as they think the cigar bud has run out of smoke. They couldn't be more wrong, in my opinion, Pool Corp. is a monster of a company and an even better stock. Here's why.

Earnings and balance sheet

Pool Corp. posted a strong Q1 with a revenue beat of $235.31 million and an EPS beat of $1.22. The company has a 10-year revenue compound annual growth rate (CAGR) of 10.7% and a free cash flow (FCF) yield of 10.1%. Driving these impressive results is the fact that the company is the world's largest swimming pool equipment distributor and still seeks to expand into new territories whilst servicing its existing pool segment.

Source: Morningstar

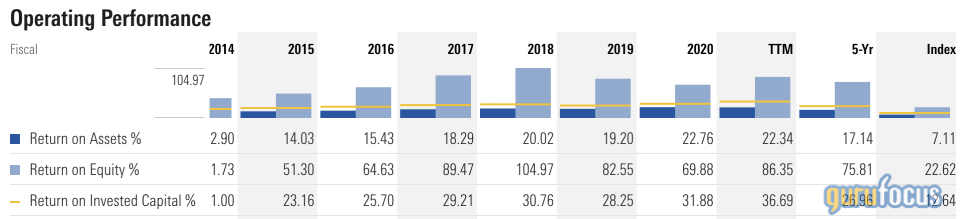

The company's return metrics beat the market average all ends ups. Pool Corp. is magnificent at utilizing investors' capital and it manages its asset-heavy business efficiently. To add to the metrics, Pool's European sales have increased 115% year-over-year as the company continues to expand in Europe. This adds to the quality and consistency of the company's earnings.

Acquisitions

I expect the company to continue producing blockbuster earnings based on its business model alone, but acquisitions should increase both top-line and bottom-line earnings as well.

Pool Corp. has an asset acquisition strategy where it acquires distribution centers in order to extend customer reach. They also cannibalize unprofitable centers, which keeps the business streamlined. In 2020 alone, the company acquired Northeastern Swimming Pools, TWC distributors and Master Tile Network. These acquisitions will extend their reach in Florida, New York, New Jersey and Texas.

Shareholder Value

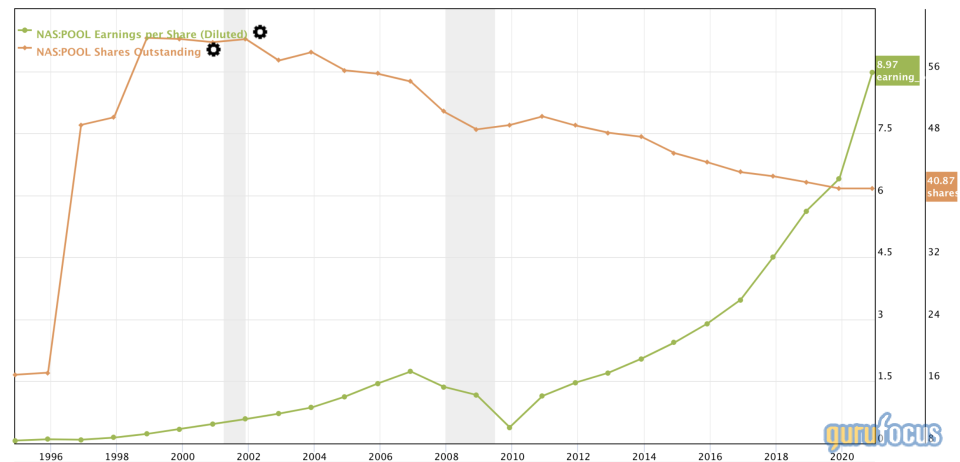

Pool Corp. has bought back shares aggressively over the past decade with its latest share buyback being a $66 million purchase of stock during 2021. The company has also raised its latest quarterly dividend by 38%.

The company's shares outstanding have consistently decreased while its diluted EPS has increased. By constantly reducing shares outstanding whilst increasing bottom-line earnings, Pool Corp. is focused on catalyzing its stock price to continue higher.

Final word

Pool Corp. is overlooked by many as being overvalued, but it's a real powerhouse. Financial strength and operational efficiency contribute to the stock's appreciation. The company maximizes shareholder value through share buybacks and dividends, so in my view, the stock is a still a buy at current levels.

This article first appeared on GuruFocus.