Is Plug Power Stock a Buy After Cratering 75%?

Plug Power (NASDAQ: PLUG) stock has gotten a lot cheaper recently, at least when it comes to its share price. In 2023, shares topped out at around $12. Today, the stock is valued at under $3.

Is this growth stock a buy after losing 75% of its value?

Plug Power has dreams of massive growth

Plug Power's management team has lofty expectations for the business. In 2027, executives expect to generate $6 billion in revenue. By 2030, they believe the business could bring in around $30 billion in revenue. These are incredible estimates when you realize the current market cap for Plug Power is only $2 billion. If its 2030 revenue estimates are achieved, and shares trade at the same price-to-sales multiple as today, the company would be worth around $55 billion, producing massive upside for long-term shareholders.

There's only one problem: It's highly unlikely that Plug Power will realize its lofty vision for revenue growth. The company simply doesn't have a great track record of hitting targets. In 2023, for instance, Plug Power generated sales of $891 million. Management's former target, however, was $1.2 billion.

Despite a track record of missing financial targets, Plug Power is still growing revenue at a respectable pace. Sales in 2023 grew 27% year over year. This growth is largely due to increased demand for hydrogen fuel cells, Plug Power's primary business. According to McKinsey & Company, a global consultancy, hydrogen demand could exceed 400 metric tons by 2050. That's up from around 90 metric tons in 2020. That shift is being driven by rising interest in renewable energy and non-polluting power sources. It's possible that, decades down the road, a meaningful chunk of the global economy will be running on hydrogen.

The question isn't whether Plug Power is exposed to a market capable of massive growth, but whether it can actually benefit from these long-term growth tailwinds. The company has recently been laying off workers, cutting prices on its arguably inferior hydrogen technology, and rushing to sell massive blocks of stock to shore up dwindling cash reserves.

The company was even issued a going concern notice by its accountants, warning that it could soon be forced into bankruptcy without additional funds. While it has since resolved this going concern -- executives recently assured the market that the company has enough cash to survive "for the foreseeable future" -- there's no guarantee that Plug Power will be able to benefit from the long-term rise in hydrogen demand. That's especially true considering early stage demand can be very lumpy. While sales rose by 27% in 2023, revenue for the first quarter of 2024 fell by 45% year over year. On a trailing 12-month basis, sales have only rise by around 4%. Volatile sales growth poses a challenging reality for a company struggling with solvency.

Does Plug Power stock have 2,300% upside?

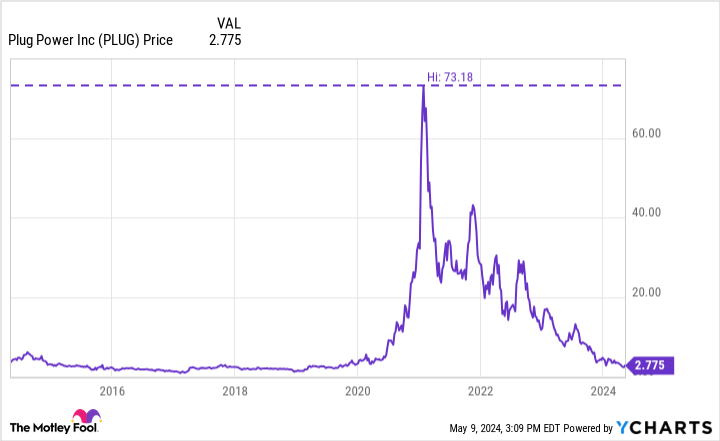

It can be tempting to look at a price chart for Plug Power stock and believe huge gains could be just around the corner. If the stock retested its previous highs set in 2021, for example, there would be more than 2,300% upside. But don't let the price chart fool you -- it's very unlikely the stock will ever come close to those former highs.

One of the biggest issues is dilution. Since those highs in 2021, Plug Power's share count has nearly doubled. That means each share of stock lays claim to only half of what it did just a few years ago. This dilution won't abate anytime soon, as the company is burning more than $1 billion per year in cash to support its growth plans.

In January, the company authorized a $1 billion share sale, which it can tap at any point. Apart from government subsidies, expect this financing method to be Plug Power's main tool for remaining solvent. Each share of stock, then, will own less and less of the company with every passing quarter.

Even if massive share dilution can keep the company afloat, it's unlikely that current shareholders will profit. Most estimates, including those from McKinsey & Company, don't expect the hydrogen market to pick up meaningfully until 2030. If Plug Power is able to survive until then through share dilution, current shareholders simply won't own that much of the company by the time conditions improve.

Put simply, the company is stuck between a rock and a hard place. It's targeting a large and growing market, but its current financial situation and technological offerings may prevent the company from actually benefiting.

Volatile stocks like this can go on a run at any moment. But wise investors are better off leaving this lottery ticket to someone else.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $553,880!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Plug Power Stock a Buy After Cratering 75%? was originally published by The Motley Fool