Is Petro-king Oilfield Services (HKG:2178) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Petro-king Oilfield Services Limited (HKG:2178) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Petro-king Oilfield Services

What Is Petro-king Oilfield Services's Net Debt?

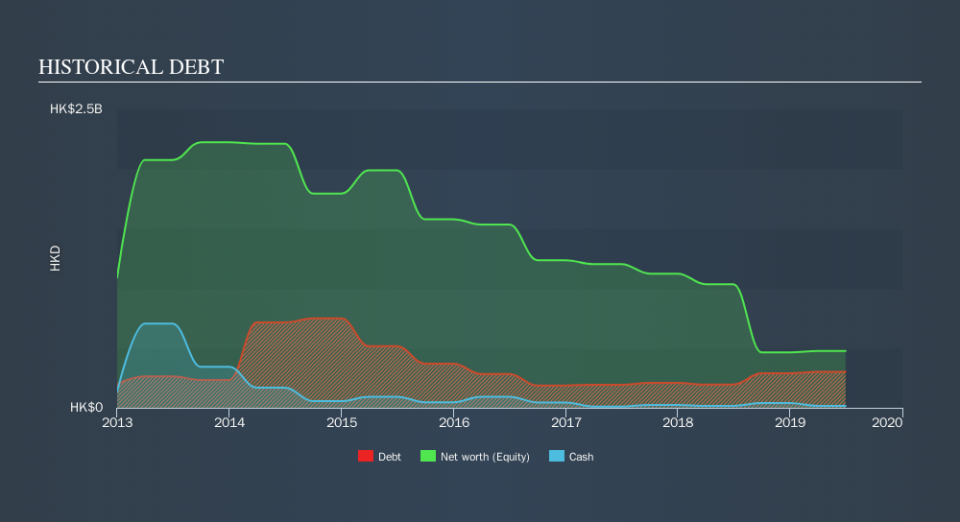

The image below, which you can click on for greater detail, shows that at June 2019 Petro-king Oilfield Services had debt of HK$301.2m, up from HK$195.0m in one year. However, it does have HK$15.2m in cash offsetting this, leading to net debt of about HK$286.0m.

How Healthy Is Petro-king Oilfield Services's Balance Sheet?

We can see from the most recent balance sheet that Petro-king Oilfield Services had liabilities of HK$339.5m falling due within a year, and liabilities of HK$168.8m due beyond that. Offsetting this, it had HK$15.2m in cash and HK$296.8m in receivables that were due within 12 months. So it has liabilities totalling HK$196.3m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of HK$250.4m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Petro-king Oilfield Services will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Petro-king Oilfield Services wasn't profitable at an EBIT level, but managed to grow its revenue by38%, to HK$359m. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Petro-king Oilfield Services still had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost a very considerable HK$97m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled HK$95m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Petro-king Oilfield Services insider transactions.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.