The past year for ATA IMS Berhad (KLSE:ATAIMS) investors has not been profitable

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held ATA IMS Berhad (KLSE:ATAIMS) during the last year don't lose the lesson, in addition to the 89% hit to the value of their shares. That'd be a striking reminder about the importance of diversification. Even if you look out three years, the returns are still disappointing, with the share price down83% in that time. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for ATA IMS Berhad

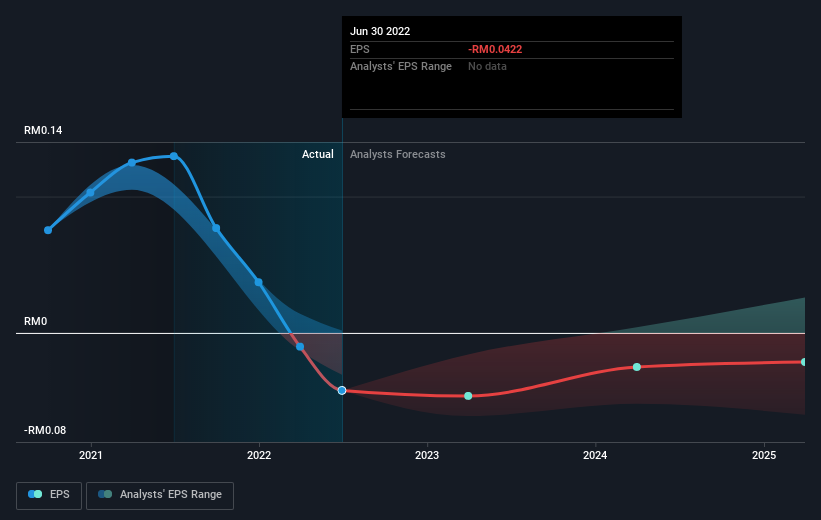

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

ATA IMS Berhad fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. We hope for shareholders' sake that the company becomes profitable again soon.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into ATA IMS Berhad's key metrics by checking this interactive graph of ATA IMS Berhad's earnings, revenue and cash flow.

A Different Perspective

ATA IMS Berhad shareholders are down 89% for the year, falling short of the market return. Meanwhile, the broader market slid about 7.0%, likely weighing on the stock. Shareholders have lost 22% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for ATA IMS Berhad that you should be aware of.

Of course ATA IMS Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here