Nexteer Automotive Group (HKG:1316) Shareholders Have Enjoyed A 74% Share Price Gain

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Nexteer Automotive Group Limited (HKG:1316) shareholders might be concerned after seeing the share price drop 13% in the last month. On the bright side the returns have been quite good over the last half decade. After all, the share price is up a market-beating 74% in that time.

See our latest analysis for Nexteer Automotive Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

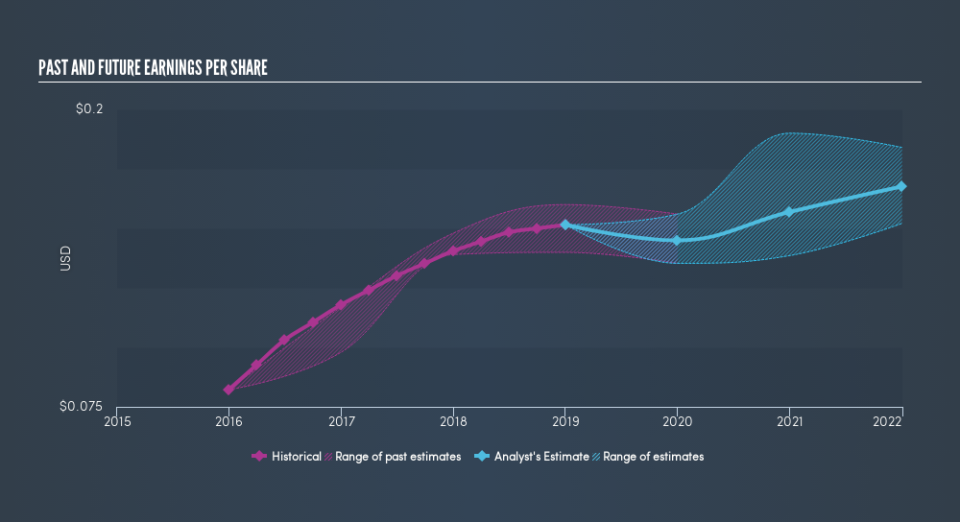

During five years of share price growth, Nexteer Automotive Group achieved compound earnings per share (EPS) growth of 21% per year. This EPS growth is higher than the 12% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 8.15 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Nexteer Automotive Group's key metrics by checking this interactive graph of Nexteer Automotive Group's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Nexteer Automotive Group, it has a TSR of 88% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 4.0% in the twelve months, Nexteer Automotive Group shareholders did even worse, losing 17% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how Nexteer Automotive Group scores on these 3 valuation metrics.

But note: Nexteer Automotive Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.