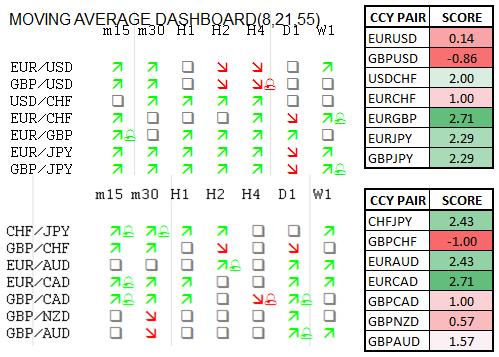

Momentum Scorecard: Euro Favored against AUD, CAD, GBP

Want to add the Moving Average Dashboard to your charts?

Download it free on FXCMApps.com.

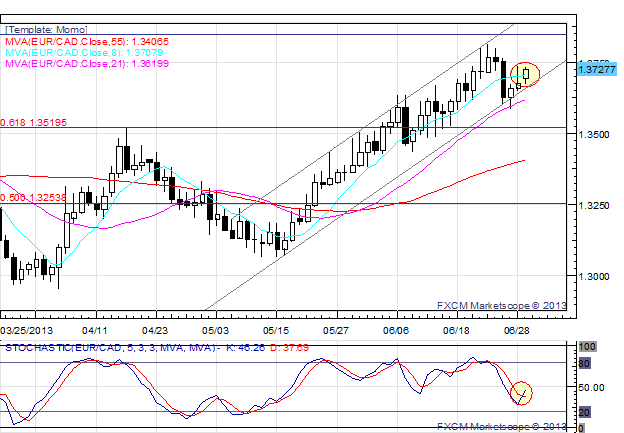

TREND IN FOCUS: EURCAD (D1)

- The recent setback in EURCAD saw the pair fall to channel support and the 21-SMA at 1.3585/625, but a daily Hammer (bullish reversal candle) put focus for a move higher.

- Daily Slow Stochastics (5,3,3) have turned higher, issuing a buy signal today for the first time since June 18.

- Concurrently, H4 Slow Stochastics (5,3,3) issued a buy signal on the close of the 21:00 EDT to 01:00 EDT candle overnight (June 30 into July 1).

- Daily RSI (14) hasn’t moved below 55 in pullbacks since May 22, signaling a strong uptrend.

- A move higher targets the June high at C$1.3800/20 and the 76.4% Fib of the June 2011 high to August 2012 low at 1.3845/50.

*Trend definitions: “uptrend” is defined as 8-MA>21-MA>55-MA; “downtrend” is defined as 8-MA

*Scoring methodology: there are seven time frames, ascending from m15 (15-minutes) to W1 (one-week). In ascending order, each pair is assigned a value from -7 to +7 based on the trend apparent on the specified time frame (I.E. a m15 uptrend equals +1, whereas a H1 downtrend equals -3). If neither an uptrend nor downtrend is present, the trendless timeframe receives a score of 0. These points are totaled and the average is reported on the right. The strongest uptrend would achieve a score of +4.00, while the strongest downtrend would achieve a score of -4.00.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.