Some Miliboo Société anonyme (EPA:ALMLB) Shareholders Are Down 30%

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Miliboo Société anonyme (EPA:ALMLB) shareholders, since the share price is down 30% in the last three years, falling well short of the market return of around 39%. And the share price decline continued over the last week, dropping some 7.5%. But this could be related to the soft market, which is down about 3.3% in the same period.

Check out our latest analysis for Miliboo Société anonyme

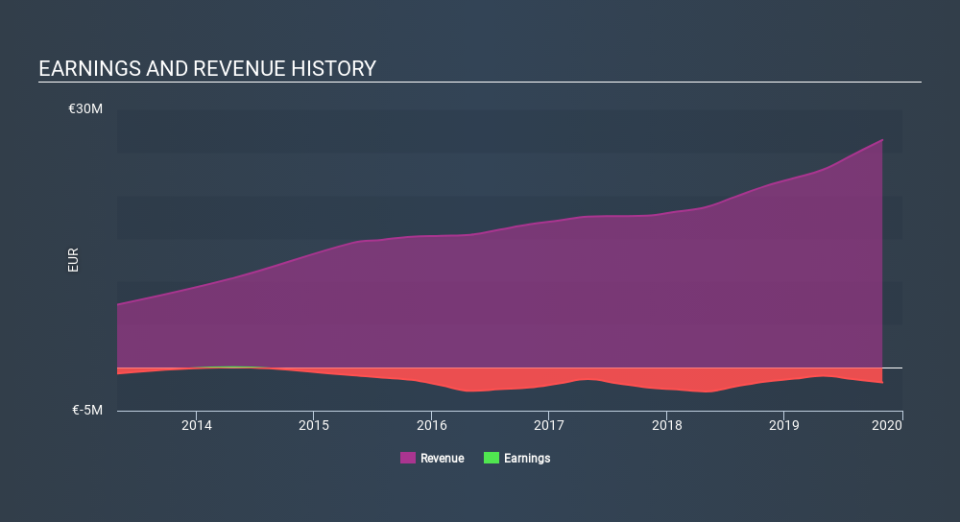

Given that Miliboo Société anonyme didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Miliboo Société anonyme saw its revenue grow by 15% per year, compound. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 11% per year, for three years. This implies the market had higher expectations of Miliboo Société anonyme. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Miliboo Société anonyme's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the market return was 19% in the last year, Miliboo Société anonyme returned 17% to shareholders. Shareholders can take comfort that it's certainly better than the yearly loss of about 11% per year endured over the last three years. The optimist would say that this might be the dawn of a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Miliboo Société anonyme that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.