Should Investors Buy Bristol Myers or CVS Stock Near 52-week Lows?

Investors are often on the lookout for strong companies that may be undervalued and present lucrative long-term opportunities.

Two names that come to mind in this regard are Bristol Myers Squibb (BMY) and CVS Health (CVS). Let’s see if it’s time to buy either stock after recently hitting their 52-week lows.

Valuation

What sticks out when looking at Bristol Myers and CVS stock is their price to earnings valuation.

Bristol Myers earnings are steady as a leading specialty biopharmaceutical company that provides treatments for serious diseases and CVS has cemented itself as a top retail pharmacy chain with an expansive push into healthcare.

Still, both stocks look undervalued at the moment and this is certainly attractive when looking at potential upside in shares of BMY and CVS from their current levels. To that point, Bristol Myers stock trades at $65 per share and just 8.2X forward earnings which is nicely below its industry average of 18X and the S&P 500’s 17.9X.

Image Source: Zacks Investment Research

Similarly, CVS trades at 8.7X forward earnings and $77 per share. This is also beneath the benchmark and closer to its industry average of 7.5X.

Plus, CVS and Bristol Myers P/E ratios are very attractive relative to their past as illustrated in the above chart. Both stocks trade well below their decade high P/E multiple and at discounts to the median. Notably, CVS and Bristol Myers have an “A” Zacks Style Scores grade for Value.

Growth & Outlook

While their valuations are certainly attractive monitoring the growth of CVS and Bristol Myers is important. CVS stock stands out with a “B” Style Scores grade for Growth as its bottoms line continues to expand.

CVS earnings are expected to be up 2% in fiscal 2023 and rise another 3% in FY24 at $9.11 per share. On the top line, sales are forecasted to rise 3% this year but dip -4% in FY24 to $319.09 billion. Still, fiscal 2024 would be 24% above pre-pandemic levels with 2019 sales at $256.77 billion.

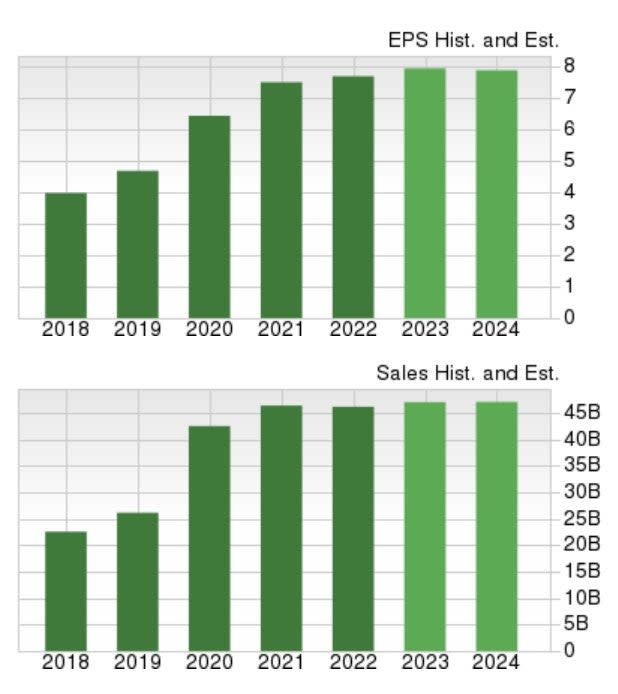

Image Source: Zacks Investment Research

Looking at Bristol Myers, BMY lands a “C” Style Scores grade for Growth. Bristol Myers earnings are projected to rise 4% this year but dip -1% in FY24 at $7.97 per share. Sales are expected to be up 2% in FY23 and rise another 1% in FY24 to $47.42 billion. Fiscal 2024 would represent 81% growth from pre-pandemic sales of $26.14 billion in 2019.

Image Source: Zacks Investment Research

Momentum & Performance

Bristol Myers and CVS stock both have a “C” Style Scores grade for Momentum as the eager sentiment surrounding many healthcare companies and pharmacies has begun to fade as we move further from the pandemic.

Bristol Myers stock is now 19% off of its 52-week highs and hit its 52-week low today. In comparison, CVS is 30% from its high after hitting its lows yesterday. Year to date, Bristol Myers stock is down -9% Vs. CVS’s -17% with both underperforming the S&P 500’s +2%. However, over the last two years, Bristol Myers’s +9% and CVS’s +6% have still outperformed the benchmark.

Image Source: Zacks Investment Research

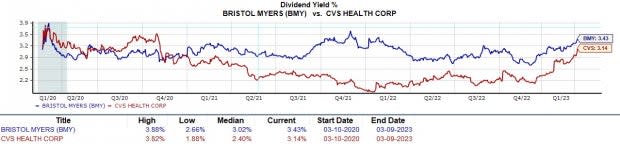

Dividends

Solid dividends are something investors can look forward to while they wait for Bristol Myers and CVS stock to regain some steam.

Both stocks have a dividend yield over 3% and much higher than the S&P 500’s average of 1.62%. Bristol Myers dividend especially stands out as it tops CVS at 3.43% and is nicely above the Medical-Biomedical/Genetics Markets 1.24%.

Image Source: Zacks Investment Research

Takeaway

The significance of Healthcare including retail pharmacies may be overlooked as we move away from the Covid-19 pandemic. Bristol Myers and CVS stock may be two prime examples of such with both landing a Zacks Rank #3 (Hold) at the moment.

Although these stocks are off to a bumpy 2023, holding on to shares of CVS and BMY at their current levels could still be rewarding and their P/E valuations appear to reaffirm this.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report