Insider Sell Alert: Qualcomm's Alexander Rogers Offloads 12,972 Shares

In a notable insider transaction, Alexander Rogers, President QTL & Global Affairs at Qualcomm Inc (QCOM), sold 12,972 shares of the company on December 14, 2023. This sale is part of a series of transactions over the past year, where Rogers has sold a total of 46,599 shares and made no purchases. The recent transaction has caught the attention of investors and analysts, prompting a closer look at the implications of insider selling patterns on the stock's performance.

Before delving into the analysis, it's important to understand who Alexander Rogers is within the Qualcomm Inc hierarchy. Rogers has been a key figure in the company, overseeing the QTL (Qualcomm Technology Licensing) division and handling global affairs. His role puts him at the forefront of Qualcomm's licensing operations, which are a significant source of revenue for the company. His insider perspective on the company's performance and prospects makes his trading activities particularly noteworthy.

Qualcomm Inc is a leading player in the semiconductor industry, specializing in wireless technology and the development of mobile chipsets. The company's products and services are integral to the operation of mobile devices, networks, and telecommunications systems worldwide. Qualcomm's business model revolves around the design, manufacture, and marketing of digital communication products and services, which has positioned it as a key enabler of the global wireless ecosystem.

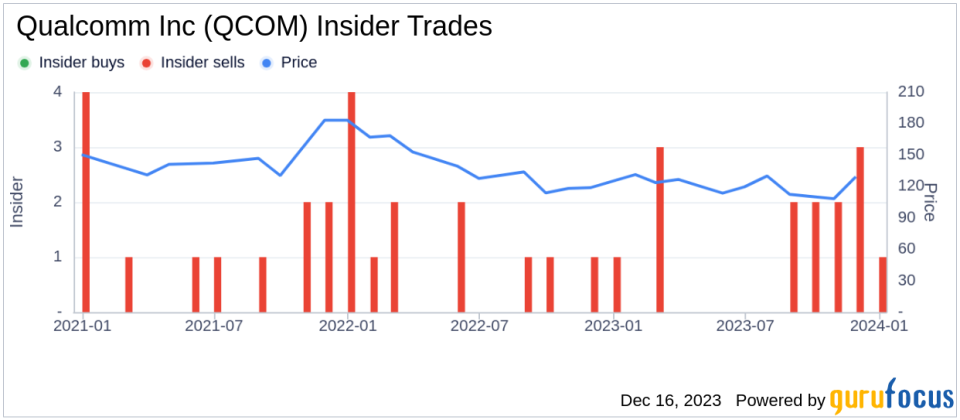

The relationship between insider trading activities and stock price movements is often scrutinized for insights into company health and management confidence. In the case of Qualcomm, the insider transaction history over the past year shows a lack of insider purchases, with 14 insider sells recorded during the same period. This trend could suggest that insiders, including Rogers, may perceive the stock's current valuation as ripe for realizing gains, or it could reflect a standard diversification of personal investment portfolios.

On the day of Rogers's recent sale, Qualcomm shares were trading at $140.5, giving the company a market cap of $159.3 billion. The stock's price-earnings ratio stood at 22.29, which is lower than the industry median of 26.47, indicating a potentially more attractive valuation relative to peers. However, it is higher than Qualcomm's historical median price-earnings ratio, suggesting that the stock may not be as undervalued as it has been in the past.

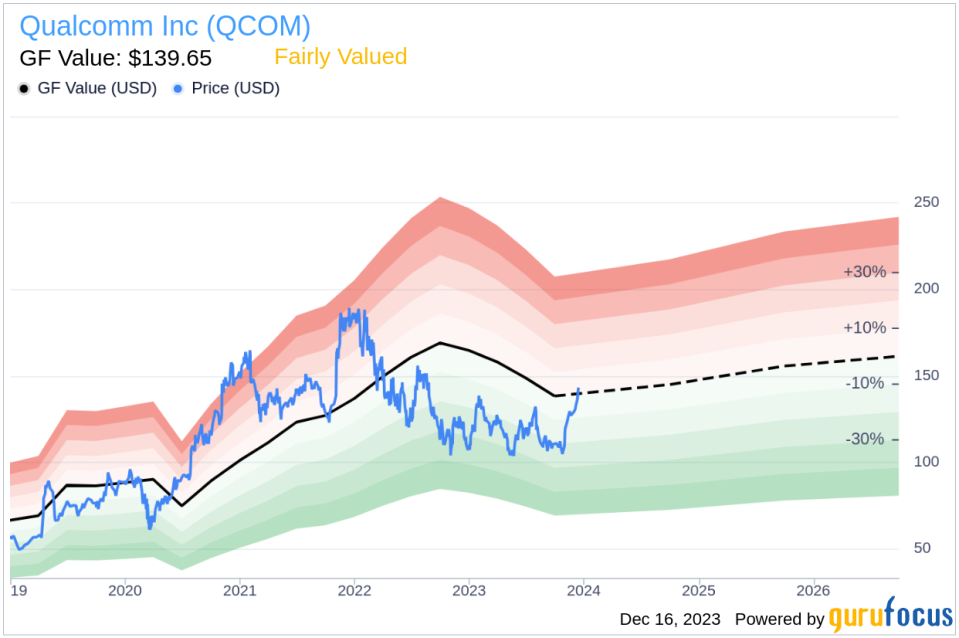

Considering the stock's valuation in relation to the GuruFocus Value (GF Value), Qualcomm Inc appears to be Fairly Valued. The GF Value of $139.65, when compared to the current price of $140.5, results in a price-to-GF-Value ratio of 1.01. This metric implies that the stock is trading at a price close to what is considered its intrinsic value, based on historical trading multiples, an adjustment factor for past performance, and future business estimates from analysts.

The GF Value is a proprietary metric developed by GuruFocus and is calculated using the following factors:

Historical multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

An adjustment factor based on the company's past returns and growth.

Future business performance estimates provided by Morningstar analysts.

When analyzing insider sell trends, it's crucial to consider the broader context. While a series of insider sells could signal caution, it is also common for executives to sell shares for personal financial planning reasons, unrelated to their outlook on the company's future. Moreover, insider sells must be weighed against the overall insider ownership percentage and the company's share repurchase activities, if any.

The insider trend image above provides a visual representation of the selling pattern over the past year. The absence of insider buys may raise questions, but it is not necessarily indicative of a lack of confidence in the company's prospects. It is also worth noting that insider transactions represent just one piece of the puzzle when it comes to investment decision-making.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value. Investors often use this information to gauge whether a stock is overvalued, undervalued, or fairly valued, which can influence investment decisions.

In conclusion, the recent insider sell by Alexander Rogers at Qualcomm Inc warrants attention, but should not be viewed in isolation. Investors should consider the company's valuation, the broader insider trading trends, and other fundamental factors before making any investment decisions. As always, a well-rounded analysis that includes insider activity is a prudent approach to understanding the potential future direction of a stock's price.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.