Insider Sell Alert: Cencora Inc's Steven Collis Parts with 42,885 Shares

In a notable insider transaction, Steven Collis, the Chairman, President & CEO of Cencora Inc (NYSE:COR), sold 42,885 shares of the company on December 13, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's internal perspective.

Who is Steven Collis of Cencora Inc?

Steven Collis is a prominent figure at Cencora Inc, holding the positions of Chairman, President, and CEO. His leadership has been instrumental in steering the company's strategic direction and operational performance. Collis's extensive experience in the industry and his role at the helm of Cencora Inc make his stock transactions particularly noteworthy to the investment community.

Cencora Inc's Business Description

Cencora Inc is a leading firm within its sector, specializing in [insert sector description]. The company has established a strong market presence with its [insert key products/services], catering to a diverse clientele. Cencora Inc's commitment to innovation and customer service has positioned it as a competitive player in the market.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by Steven Collis is part of a larger pattern observed over the past year. Collis has sold a total of 212,377 shares and has not made any purchases. This one-sided transaction history could signal various things to investors. While it's not uncommon for insiders to sell shares for personal financial planning, a consistent pattern of sales without any buys might raise questions about the insider's confidence in the company's future prospects.The insider transaction history for Cencora Inc shows a total absence of insider buys over the past year, with 31 insider sells recorded during the same timeframe. This trend could suggest that insiders, including Collis, may believe that the stock is fully valued or that they are taking profits after a period of appreciation.

On the day of the insider's recent sale, shares of Cencora Inc were trading at $203.18, giving the company a substantial market cap of $39.95 billion. The price-earnings ratio stands at 23.49, which is above both the industry median of 17.36 and the company's historical median. This higher valuation could be a contributing factor to the insider's decision to sell shares.

Valuation and GF Value Analysis

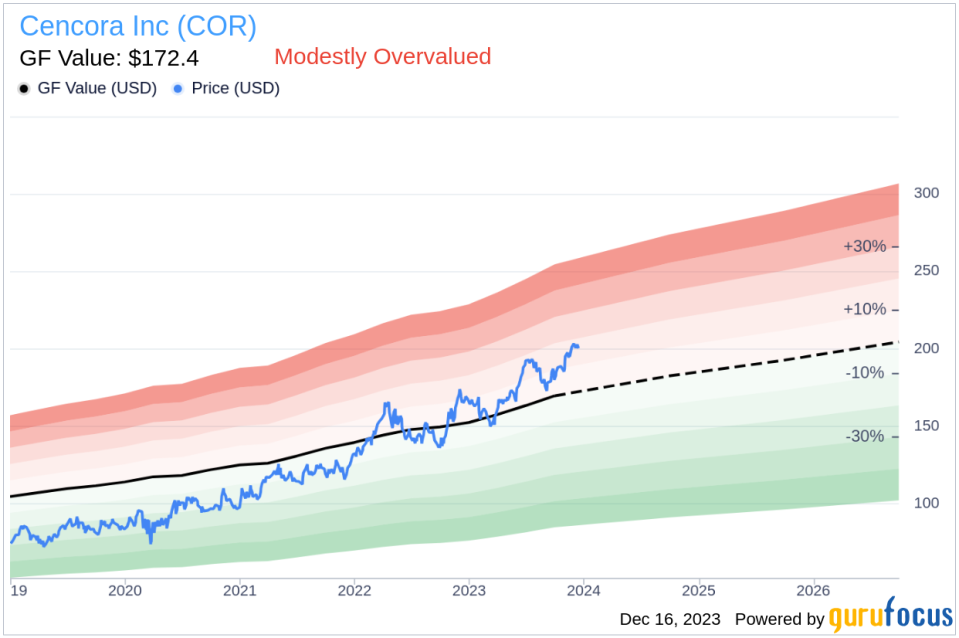

Considering the stock's price of $203.18 and comparing it to the GuruFocus Value (GF Value) of $172.40, Cencora Inc appears to be modestly overvalued with a price-to-GF-Value ratio of 1.18.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that the stock may not have much upside potential left, which could be another reason why the insider chose to reduce their holdings at this time.

Conclusion

The sale of 42,885 shares by Steven Collis is a significant event that warrants attention from Cencora Inc's investors and potential investors. While insider sales are not always indicative of a company's health or future performance, they can offer clues about how insiders view the stock's valuation. In the case of Cencora Inc, the pattern of insider sales, the absence of insider buys, and the stock's valuation relative to the GF Value suggest that insiders like Collis may perceive the stock as being on the higher end of its value range. Investors should consider these factors alongside broader market analysis when making investment decisions regarding Cencora Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.