The Hong Kong Building And Loan Agency Limited (HKG:145): Is Financials Attractive Relative To SEHK Peers?

The Hong Kong Building And Loan Agency Limited (SEHK:145), a HK$350.59M small-cap, is a financial services company operating in an industry, whose performance can be gauged by house price index and the stock market which are proxies for market confidence for credit. Financial services analysts are forecasting for the entire industry, a strong double-digit growth of 10.87% in the upcoming year . Today, I will analyse the industry outlook, as well as evaluate whether Hong Kong Building And Loan Agency is lagging or leading in the industry. View our latest analysis for Hong Kong Building And Loan Agency

What’s the catalyst for Hong Kong Building And Loan Agency’s sector growth?

The mortgage industry is characterized by stable product offerings, consolidation and increasing levels of external competition. In the previous year, the industry saw growth of 9.94%, though still underperforming the wider Hong Kong stock market. Hong Kong Building And Loan Agency lags the pack with its sustained negative earnings over the past couple of years. The company’s outlook seems uncertain, with a lack of analyst coverage, which doesn’t boost our confidence in the stock. This lack of growth and transparency means Hong Kong Building And Loan Agency may be trading cheaper than its peers.

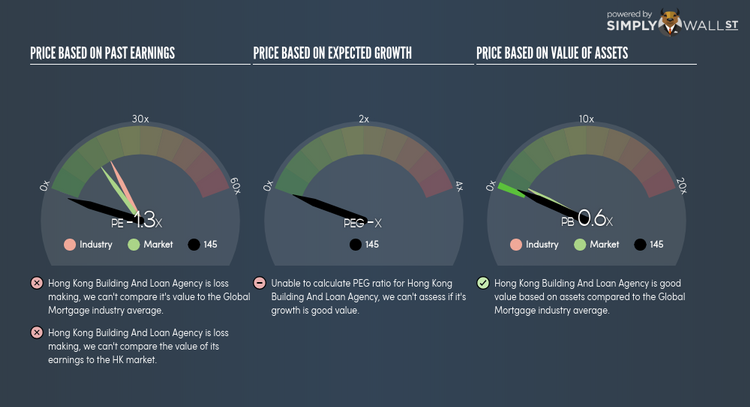

Is Hong Kong Building And Loan Agency and the sector relatively cheap?

The mortgage and thrifts sector’s PE is currently hovering around 18.9x, in-line with the Hong Kong stock market PE of 14.5x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. However, the industry returned a lower 7.42% compared to the market’s 10.13%, potentially indicative of past headwinds. Since Hong Kong Building And Loan Agency’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge Hong Kong Building And Loan Agency’s value is to assume the stock should be relatively in-line with its industry.

Next Steps:

Hong Kong Building And Loan Agency recently delivered an industry-beating growth rate in earnings, which is a positive for shareholders. If the stock has been on your watchlist for a while, now may be the time to buy, if you like its ability to deliver growth and are not highly concentrated in the financial industry. However, before you make a decision on the stock, I suggest you look at Hong Kong Building And Loan Agency’s fundamentals in order to build a holistic investment thesis.

1. Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

2. Historical Track Record: What has 145’s performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

3. Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Hong Kong Building And Loan Agency? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.